Acala Swap Fee & Speed Calculator

Comparison Results

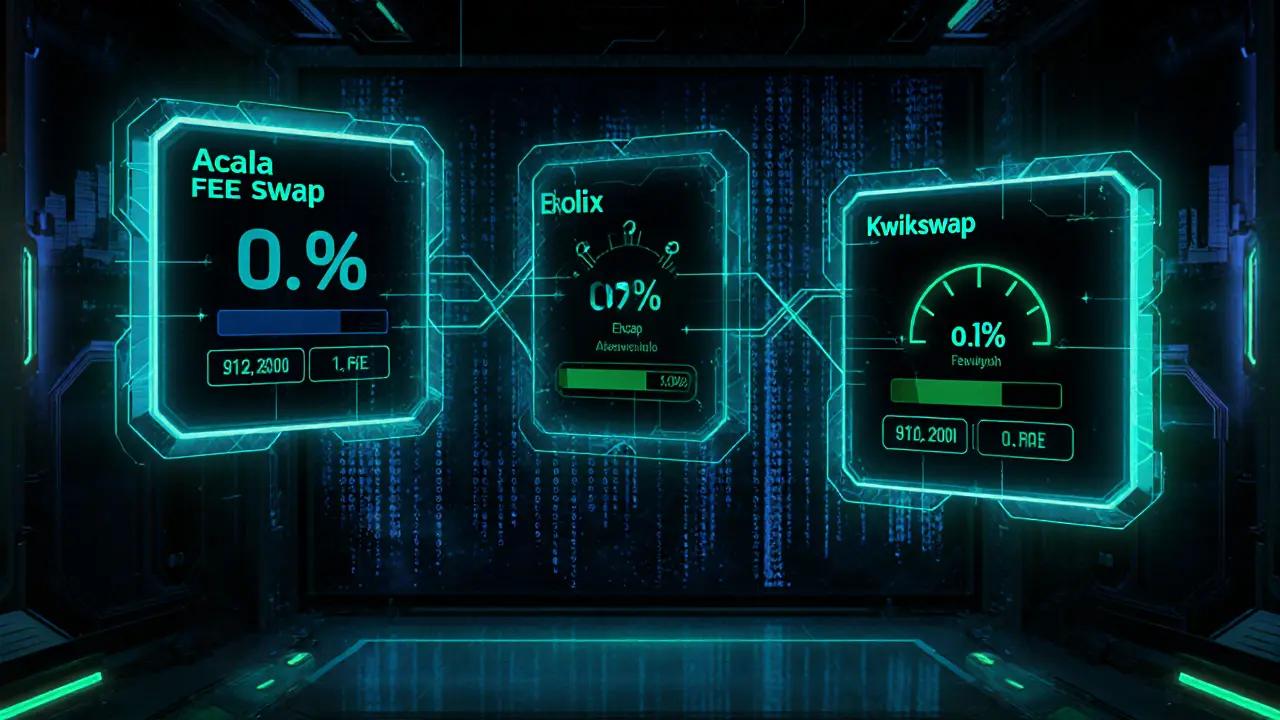

Acala Swap

0.3% feeNetwork Fee:

$0.00

Swap Fee:

$0.00

Total Cost:

$0.00

Exolix

0.2% + networkNetwork Fee:

$0.00

Swap Fee:

$0.00

Total Cost:

$0.00

Kwikswap

0.1% + networkNetwork Fee:

$0.00

Swap Fee:

$0.00

Total Cost:

$0.00

Recommendation

Based on your trade amount and token type, we recommend using Acala Swap for optimal cost efficiency.

About Acala Swap

Acala Swap is the native DEX module of the Acala Network, built on Polkadot. It uses an Automated Market Maker (AMM) model with a 0.3% default fee. While it offers low network fees due to Polkadot's efficiency, liquidity can be thin, affecting slippage on larger trades.

Third-party aggregators like Exolix, SwapSpace, and Kwikswap often provide faster execution and potentially lower fees, especially for smaller trades.

TL;DR

- Acala Swap is the native DEX module of the Acala Network, built on Polkadot.

- It lets you trade ACA and other assets without a central order book, but liquidity can be thin.

- Third‑party services like Exolix, SwapSpace and Kwikswap often offer faster, cheaper swaps for ACA.

- ACA token price is volatile, trading around $0.023-$0.024 in 2025.

- Consider your risk tolerance and need for speed before choosing Acala Swap over aggregators.

When you hear the name Acala Swap is the native decentralized swapping module built into the Acala Network, a Polkadot‑based DeFi platform, you’re looking at a tool that lets you trade the ACA token and other assets without a centralized order book. This review breaks down how the swap works, what fees you can expect, and whether you’d be better off using third‑party aggregators.

What Is Acala Swap?

Acala Network is a layer‑1 smart‑contract platform that runs on the Polkadot ecosystem, combining Substrate and Ethereum Virtual Machine (EVM) compatibility. Within this ecosystem, Acala Swap acts as the built‑in decentralized exchange (DEX) that enables token swaps directly on‑chain.

Because the network is a parachain on Polkadot is a multi‑chain protocol that connects independent blockchains, allowing assets to move freely between them, Acala Swap benefits from fast finality and low transaction fees compared with Ethereum‑only DEXs.

How Swapping Works on Acala

The swap process relies on an automated market maker (AMM) model. Liquidity providers deposit ACA and other supported assets into pools, and the AMM uses a constant‑product formula (x*y=k) to price trades. When you initiate a swap, the protocol calculates the spot price, applies a small fee (usually 0.3% of the trade volume), and adjusts the pool balances accordingly.

All operations execute as smart contracts on the Ethereum Virtual Machine is a runtime environment that runs smart contracts written in Solidity and other languages layer of Acala, while the underlying storage and consensus are handled by Substrate is the blockchain framework that powers Polkadot parachains, offering modular runtime upgrades. This hybrid approach gives developers the flexibility of Ethereum tools and the scalability of Polkadot.

ACA Token Performance in 2025

The native token, ACA is the governance and utility token of the Acala Network, used for staking, fee payment, and voting on protocol upgrades, has been trading in a narrow band around $0.023-$0.024. Technical analysis shows the price sits below its 7‑day simple moving average (SMA) of $0.0255 and the 30‑day SMA of $0.0285, indicating short‑term bearish pressure.

Despite the current dip, long‑term forecasts differ wildly. Some analysts project ACA could reach $2.79 by late 2025 if Polkadot DeFi adoption accelerates, while more conservative models keep the price near $0.023. The volatility underscores the need for careful risk management when swapping large amounts.

Third‑Party Swapping Options for ACA

Because Acala Swap’s native liquidity can be thin, many users turn to external services that aggregate across multiple DEXes. Below is a quick comparison of three popular platforms that support ACA:

| Platform | Average Fee | Swap Speed | Supported Tokens | Custody Model |

|---|---|---|---|---|

| Exolix is a non‑custodial exchange that swaps ACA for major coins like BTC, ETH, BNB, and others in under 9 minutes | 0.2%+network fee | ~5‑9minutes | ACA, BTC, ETH, BNB, XRP, others | Non‑custodial (you retain private keys) |

| SwapSpace is an aggregator that pulls rates from over 3,850 crypto assets, including ACA, without charging extra fees | 0%+network fee | Instant (depends on selected DEX) | 3,850+ assets, ACA included | Mixed - you can choose custodial or non‑custodial routes |

| Kwikswap Protocol is a dedicated DEX for Acala that advertises ultra‑fast swaps and minimal fees | 0.1%+network fee | ~30‑60seconds | ACA, aRNA, stablecoins on Acala | Non‑custodial (on‑chain) |

All three platforms are compatible with major wallets like Polkadot{.js}, MetaMask (via the Acala EVM bridge), and Ledger hardware wallets. Your choice will depend on how much you value speed versus fee transparency.

User Experience & Security Considerations

Acala Swap itself requires no registration; you connect a wallet directly to the interface. This self‑custody model reduces the risk of hacks on centralized services, but it also means you’re fully responsible for safeguarding private keys. In contrast, services like Exolix emphasize a “no‑registration” flow but still require you to sign a transaction, keeping you in control of keys.

Trust scores from independent review sites (such as Trustpilot) give Exolix a rating above 4.5/5, based on thousands of user reviews emphasizing speed and anonymity. SwapSpace’s reputation hinges on its aggregator model-users praise the ability to find the best rate instantly, though occasional latency spikes can occur when the underlying DEX is congested.

Regulatory risk remains a factor. Because Acala is a parachain on Polkadot, its legal standing follows broader EU and US guidance on interoperable blockchain services. No explicit licensing is required for swapping ACA, but future regulations could impact how aggregators present rates or collect user data.

Pros & Cons of Using Acala Swap

- Pros

- Fully on‑chain, no custodial middle‑man.

- Low network fees thanks to Polkadot’s efficient consensus.

- Direct access to ACA’s native liquidity pools.

- Cons

- Liquidity can be shallow, leading to price slippage on larger trades.

- Limited token support beyond assets built on Acala.

- Interface is still maturing; fewer UI polish features than big DEXes.

Should You Use Acala Swap?

If you’re a small‑to‑medium trader who values privacy and wants to keep everything on the Acala parachain, the native swap works fine for swaps under a few hundred dollars. For bigger moves, or if you need the best possible rate, checking an aggregator like SwapSpace or a specialized service such as Exolix is prudent.

Remember that ACA’s price volatility means a modest 0.3% fee can translate into noticeable dollar differences when the token value spikes. Always compare the total cost (fee+slippage) before confirming a trade.

Finally, keep an eye on roadmap updates from the Acala team. New liquidity mining programs or cross‑chain bridges could dramatically improve native swap depth, making the native option more attractive in the near future.

Frequently Asked Questions

What tokens can I trade on Acala Swap?

Acala Swap currently supports ACA, aRNA (Acala’s stablecoin), and a handful of other assets that have been deployed on the Acala parachain. Most users pair ACA with aRNA or other stablecoins to minimize slippage.

How much does Acala Swap charge per trade?

The default fee is 0.3% of the trade amount, similar to many AMM‑based DEXes. There are no hidden fees, but you still pay the underlying Polkadot network fee (usually a few cents).

Is Acala Swap safe for beginners?

Yes, if you already have a Polkadot‑compatible wallet and understand how to approve transactions. The interface is simple, but always double‑check the token symbols and amounts before confirming.

Can I use a hardware wallet with Acala Swap?

Absolutely. Ledger and Trezor devices are supported via the Polkadot{.js} extension, letting you sign swaps without exposing private keys online.

What’s the difference between Acala Swap and Kwikswap?

Kwikswap is a separate DEX built on top of Acala that focuses on ultra‑fast swaps and lower fees. It uses a similar AMM model but aggregates liquidity from multiple pools, often resulting in less slippage for small trades.

Should I swap through a third‑party aggregator instead?

If you need the best price or faster execution, services like Exolix or SwapSpace are worth checking. They pull rates from many DEXes, so you can compare the total cost before confirming.

april harper

February 27, 2025 AT 08:16In the grand theatre of decentralized finance, Acacia Swap emerges like a lone actor on a dim stage, whispering promises of low fees while the audience watches the shadows of thin liquidity. The 0.3% fee, though modest, can swell into a monstrous sum when the token price spikes like a fevered comet. One cannot help but linger on the paradox: a parachain built for speed, yet its pools often echo with the emptiness of a quiet hall. Perhaps the true drama lies not in the numbers, but in the silence of traders waiting for deeper pools to fill. Still, I find myself too lazy to chase every new incentive program, preferring the comfortable lull of familiar aggregators. The decision, then, becomes a philosophical meditation on risk versus convenience, a balance as delicate as a glass of water on a trembling table. In the end, Acala Swap serves its purpose, but only for those who savor the subtle taste of modest fees over the intoxicating rush of massive liquidity.

Kate Nicholls

February 27, 2025 AT 22:10While Acala Swap markets itself as a native solution with low network fees, the reality is a mixed bag. The 0.3% fee feels reasonable on paper, yet the thin liquidity can cause slippage that erodes that advantage. Compared to Exolix or Kwikswap, the speed advantage is marginal, especially when you factor in Polkadot's finality times. If you’re swapping small amounts, the native option might be fine, but for anything beyond a few hundred dollars you’ll likely find better rates elsewhere. In short, it’s a decent fallback, not the front‑line champion.

VICKIE MALBRUE

February 28, 2025 AT 12:03Acala Swap is simple to use and the fees are low. It works well for quick small swaps. Give it a try if you already have a Polkadot wallet.

Kate Roberge

March 1, 2025 AT 01:56Wow, you really romanticize a 0.3% fee like it’s poetry. Truth is, that fee plus slippage can bite you harder than a bad coffee. If you’re okay with watching your trade shrink, go ahead. But most of us want real value, not glossy PR. The native liquidity is so thin you might as well be trading in a desert. So, keep your expectations low or hop to an aggregator.

Jason Brittin

March 1, 2025 AT 15:50Sure, Acala Swap is the *holy grail* of DEXs 🙄. Low fees? Yeah, until the pool dries up and you pay hidden slippage. The Polkadot network is fast, but that’s like having a sports car with no fuel. If you love living on the edge, enjoy the thrill of waiting for a trade to fill. Otherwise, there are better options that actually deliver on speed and cost. 🚀

Ben Dwyer

March 2, 2025 AT 05:43Your optimism about the low fees is refreshing. For newcomers, the simple interface can reduce the learning curve. Just be sure to double‑check the token pair to avoid accidental swaps. Managing slippage settings helps keep costs predictable. Overall, it’s a solid starting point for small trades.

Rajini N

March 2, 2025 AT 19:36The Acala Swap interface follows standard AMM conventions: constant‑product formula, 0.3% protocol fee, and Polkadot’s sub‑second finality. Liquidity depth, however, remains a limiting factor, especially for ACA‑aRNA pairs exceeding $500. Users should monitor the pool’s reserve ratio before executing large swaps to mitigate price impact. Utilizing the “max slippage” parameter can further control adverse movements. For best execution, consider routing through aggregator services that source additional liquidity from parallel parachains.

Oreoluwa Towoju

March 3, 2025 AT 09:30Does anyone know the typical slippage percentage for a $1,000 ACA swap on the native pool? Curious about real‑world numbers.

Amie Wilensky

March 3, 2025 AT 23:23Indeed-it’s quite the conundrum, isn’t it???; the fee structure appears modest, yet the lurking liquidity vacuum can dramatically amplify costs!!!; one must weigh the apparent simplicity against the hidden volatility!!!

Katrinka Scribner

March 4, 2025 AT 13:16i think acala swap is kinda cool 😁 but watch out for those hidden fees lol

Waynne Kilian

March 5, 2025 AT 03:10i guess we all woul be better off if the dexs just shared their pools more openly, then maybe the friction would melt away

Clint Barnett

March 5, 2025 AT 17:03Stepping into the world of Acala Swap feels like opening a dusty old tome in a dimly lit library, each page whispering promises of low fees and lightning‑fast finality. The 0.3% protocol charge, while seemingly modest, sits atop a delicate dance of liquidity that can wobble under the weight of larger trades. When the pools are shallow, the price impact can surge like a rogue wave crashing against a fragile pier. Yet the underlying Polkadot parachain offers an infrastructure as sturdy as a mountain, granting near‑instant settlement that many older chains can only dream of. For a trader seeking to move a few hundred dollars of ACA, the convenience of a native swap may outweigh the occasional slip in price. Conversely, when the order size balloons into the thousands, the thinness of the pool becomes glaringly obvious, and the effective cost can eclipse the advertised fee. Comparing this to aggregators such as Exolix or Kwikswap reveals a trade‑off: external services inject extra liquidity, sometimes shaving off fractions of a percent, but they introduce additional network hops and potential custodial concerns. The native route, on the other hand, preserves full control of one’s private keys, a benefit that resonates with the DeFi ethos of self‑sovereignty. Moreover, the user interface, while functional, still bears the scars of early‑stage development, lacking the polish of more mature platforms. Future roadmap items hint at liquidity mining programs that could thicken the pools, turning the current desert into a bustling bazaar of swaps. Until then, the prudent strategist will monitor the pool’s reserve ratios and perhaps set tighter slippage tolerances. In the grand scheme, Acala Swap embodies both the promise and the growing pains of a young ecosystem striving for relevance in a crowded market. Its low network fees are a clear advantage, especially for micro‑transactions that would otherwise be eroded by costly gas. Yet the real metric to watch remains the total cost of execution, a sum of fees, slippage, and time. As with any financial tool, understanding its mechanics before leaping in can mean the difference between a smooth trade and a costly disappointment.

Carl Robertson

March 6, 2025 AT 06:56Ah, the poetry of your prose! You paint Acala Swap as a saga of heroics, yet you gloss over the brutal reality that many users face: empty pools and broken expectations. It's almost comedic how you praise a platform that still stumbles on basic liquidity. I can't help but roll my eyes at the optimism that feels out of touch. If we keep glorifying such half‑baked solutions, the whole DeFi narrative suffers. Your colorful language masks the fact that for serious traders, Acala is often just a stepping stone, not a destination. So, while your enthusiasm is noted, let's not pretend it's the end‑all be‑all of decentralized swapping.

MD Razu

March 6, 2025 AT 20:50The very notion of swapping tokens on a burgeoning parachain invites us to contemplate the essence of value transfer in a fragmented digital cosmos. When Acala Swap proclaims a 0.3% fee, it is not merely stating a number but asserting a philosophy of modest cost amidst the chaos of blockchain economics. Yet the liquidity that underpins this philosophy resembles a thin veil, barely containing the storm of market orders that surge through its channels. One could argue that the pursuit of lower fees is akin to seeking serenity in a bustling metropolis-possible, yet fraught with hidden turbulence. The trade‑off, therefore, becomes a dialectic between self‑custody, which preserves sovereignty, and the pragmatic need for depth, which ensures price stability. As users navigate this tension, the decision matrix expands: do we accept the occasional slippage for the virtue of staying on‑chain, or do we surrender control to aggregators that promise efficiency at the cost of custodial exposure? In the end, Acala Swap's role may be transitional, a stepping stone towards a more mature liquidity ecosystem that can truly embody its low‑fee promise without sacrificing execution quality. Until that day arrives, participants must weigh their risk appetite against the stark reality of thin pools, crafting strategies that acknowledge both the allure and the limitations of this nascent DEX.

Charles Banks Jr.

March 7, 2025 AT 10:43Oh, absolutely, because dismissing an entire platform with a single paragraph is the hallmark of deep analysis. If only we could all agree on one viewpoint and stop the chaotic discourse. Your criticism feels as fresh as yesterday's news. Maybe next time, try adding a slice of constructive feedback instead of just waving a flag of doom.

Lindsay Miller

March 8, 2025 AT 00:36I understand how confusing fee structures can be, especially when you’re just starting out. It helps to take things step by step and keep an eye on the total cost, not just the headline fee.

Naomi Snelling

March 8, 2025 AT 14:30Everyone talks about low fees like it’s a free lunch, but have you considered who’s actually funding the network? The Polkadot validators might be getting a hidden slice of every swap, and those aggregators are just the front men. Keep your eyes open; the picture is rarely as clean as the marketing sheets make it seem.

Michael Wilkinson

March 9, 2025 AT 04:23Enough with the theory, the numbers speak for themselves.