DeLorean (DMC) Token Staking Calculator

Estimated Annual Percentage Yield (APY)

--%

Estimated Monthly Rewards

-- DMC

Estimated Annual Rewards

-- DMC

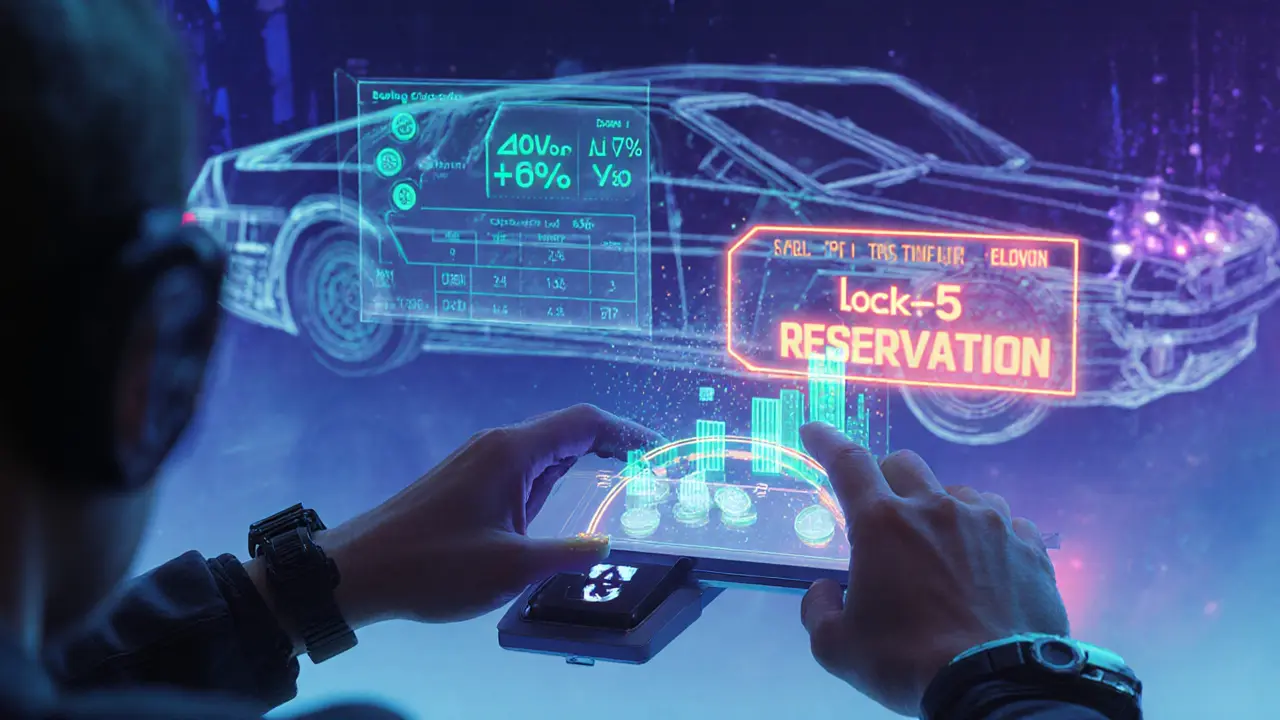

Ever wondered why a classic car name shows up in a crypto ticker? DeLorean DMC token is the bridge between the iconic DeLorean brand and modern decentralized finance. Below you’ll learn what the token actually does, how you can earn rewards, and why it matters beyond pure speculation.

What is the DeLorean (DMC) token?

DeLorean (DMC) token is a utility cryptocurrency that powers the DeLorean Labs ecosystem. It was launched to combine automotive manufacturing with blockchain‑based finance, letting holders stake tokens, reserve future vehicles, and vote on platform decisions.

Key tokenomics at a glance

| Metric | Value |

|---|---|

| Total supply | 12.8billion DMC |

| Circulating supply | 3.8billion DMC |

| Current price | $0.003081 USD |

| Market cap | $11.75million |

| 24‑hour volume | $9.58million |

| Fully diluted valuation | $39.56million |

The low circulating supply (about 30% of total) means new tokens will keep entering the market, a factor that could affect price dynamics as the project scales.

How staking works

Staking is the core staking mechanism. Holders lock DMC in smart contracts and receive rewards that come from two sources:

- Transaction fees generated on the DeLorean Labs platform.

- Buyback proceeds that the company spends to purchase DMC from the open market.

Reward tiers are tiered by the amount staked and the lock‑up period. Longer locks and larger stakes earn higher multipliers, encouraging long‑term commitment rather than quick flips.

Build slot reservations - turning a deposit into income

One of the most innovative utilities is the build slot reservation system. Instead of parking cash in a traditional vehicle deposit, users stake DMC to ‘reserve’ a production slot for the upcoming DeLorean Alpha5. While the factory builds the car (which can take months), the staked tokens keep earning the same staking rewards. When the vehicle is delivered, the reservation converts into ownership rights, and any remaining staked balance can be withdrawn.

This model solves the classic ‘dead capital’ problem for high‑value purchases and gives token holders a tangible reason to stay engaged.

Governance and brand‑affinity perks

Token holders receive governance rights. Proposals range from tweaking reward formulas to deciding which new merchandise drops get released. Voting power scales with the amount of DMC locked, creating a merit‑based decision structure.

Beyond governance, the token unlocks exclusive brand‑affinity benefits. Holders can purchase limited‑edition DeLorean apparel, vintage accessories, and collectible memorabilia directly with DMC, turning the token into a loyalty currency for fans of the brand.

Buyback mechanism - aligning profit with token value

DeLorean Labs earmarks a portion of its revenue to buy DMC from the market. These tokens are then funneled back into the staking pool, effectively reducing circulating supply while boosting reward payouts. This creates a feedback loop: higher platform revenue → larger buybacks → higher token value → more incentive to hold and stake.

Market performance and risk profile

As of today, DMC sits around #1,107 on CoinMarketCap. The 24‑hour trading range of $0.002897‑$0.003285 shows classic alt‑coin volatility. A volume‑to‑market‑cap ratio of 81.57% points to active trading, which is attractive for bots but also raises risk for swing traders.

Price predictions from 3commas suggest a modest upside toward $0.00331 by year‑end 2025, but longer‑term outlook hinges on two factors:

- Successful delivery of the Alpha5 and associated revenue streams.

- Continued community participation in staking and governance.

If production stalls, the token could revert to pure speculation, increasing price volatility.

Step‑by‑step: Getting started with DMC

- Buy DMC on a supported exchange (e.g., Binance, KuCoin).

- Transfer the tokens to your personal wallet (MetaMask or Trust Wallet work).

- Visit the official DeLorean Labs portal and connect your wallet.

- Choose a staking tier or a build‑slot reservation that matches your risk appetite.

- Lock the tokens, confirm the transaction, and start earning rewards.

Remember to keep an eye on lock‑up periods-early withdrawals can forfeit earned rewards.

Potential pitfalls and how to avoid them

- Liquidity risk: Only a fraction of total supply circulates, so large sales could impact price.

- Production delay: If Alpha5 delivery slips, reservation rewards stop, and token sentiment may falter.

- Regulatory exposure: Automotive financing and crypto assets both attract scrutiny; stay updated on local regulations.

Mitigate these risks by staking only a portion of your holdings, diversifying across other assets, and using stop‑loss orders if you trade on the open market.

Future outlook

The next 12months are decisive. DeLorean Labs plans to start limited Alpha5 production by Q22026. If the first batch ships on schedule, the buyback mechanism could see a revenue boost, tightening supply and potentially lifting DMC’s price.

Even without vehicle delivery, the platform’s staking and governance models remain functional, offering a modest yield compared to many DeFi projects. For long‑term holders, the token represents a hybrid of nostalgia, utility, and speculative upside.

Frequently Asked Questions

What can I do with DMC besides staking?

You can reserve a build slot for the upcoming DeLorean Alpha5, vote on platform proposals, and purchase exclusive merchandise using DMC.

Is DMC a security?

Currently, DMC is classified as a utility token. However, regulatory opinions can change, so it’s wise to stay informed about local laws.

How are staking rewards calculated?

Rewards stem from platform transaction fees and the buyback fund. The exact APY depends on the total amount staked, your lock‑up duration, and the current buyback volume.

Can I trade DMC on decentralized exchanges?

Yes, DMC is ERC‑20 compliant and listed on several DEXs such as Uniswap and SushiSwap. Liquidity can vary, so check pool depth before large trades.

What happens if the Alpha5 project fails?

The token would revert to a pure staking and governance utility. While the brand‑affinity perks would remain, price expectations would likely adjust to reflect the loss of vehicle‑related revenue.

Oreoluwa Towoju

March 28, 2025 AT 04:03Staking DMC can be a solid way to earn passive income while you wait for the next DeLorean release. Just make sure you lock your tokens for a period that matches your risk tolerance, and keep an eye on the APY updates.

Amie Wilensky

March 28, 2025 AT 04:06Ah, the ever‑fleeting promise of decentralized finance – a modern alchemy of code and hope; one wonders, is the token merely a vehicle for speculation, or does it truly drive innovation? The calculator offers a seductive glimpse of yields, yet the underlying mechanics remain as opaque as a vintage dashboard.

Clint Barnett

March 28, 2025 AT 04:10When you first glance at the DeLorean (DMC) token staking calculator, you’re greeted by a sleek interface that promises simplicity, but beneath that veneer lies a complex interplay of incentives that merit deeper scrutiny. The base APY of twelve percent serves as a starting point, yet the multiplier map-ranging from one for three‑month locks to two for twenty‑four‑month commitments-underscores how time becomes a lever in the reward equation. This means that a holder who can afford to lock DMC for two years essentially doubles their yield, a compelling proposition for long‑term believers. However, the real world rarely mirrors theoretical models, and transaction fees can erode the glossy percentages displayed. Moreover, the token’s utility is tied to vehicle reservations, an ambitious cross‑industry ambition that could either bolster demand or falter if the automotive partnership stalls. It’s also worth noting that the platform’s buyback volume plays a pivotal role; higher buybacks can translate to more robust reward pools, while a dip could leave stakers with diminished returns. For newcomers, the calculator’s “estimate” label should serve as a cautionary reminder that these numbers are not guarantees. The volatility inherent in cryptocurrency markets can swing both ways, turning a seemingly attractive APY into a fleeting mirage. Therefore, diversification remains a prudent strategy-don’t place all your DMC in the staking pool. If you have a passion for the iconic DeLorean brand and can tolerate the associated risks, staking can align your financial goals with your enthusiasm. Conversely, if you’re primarily motivated by speculative gains, you might consider exploring other tokens with more established liquidity. In any case, keeping a vigilant eye on platform announcements and community sentiment will help you navigate the evolving landscape. Ultimately, the decision to stake should balance personal risk appetite, confidence in the project’s roadmap, and an understanding that the most attractive yields often come with the greatest uncertainties.

Carl Robertson

March 28, 2025 AT 04:13So we have a shiny new token that promises you a ride in a legendary car if you lock your money away-how dramatic! Yet the fine print feels like a roller‑coaster of hidden fees, and the whole thing reeks of hype more than substance.

Naomi Snelling

March 28, 2025 AT 04:16Everyone’s talking about DMC like it’s the next big thing, but have you considered who’s really pulling the strings behind the scenes? There’s a reason the token’s name mirrors the back‑door projects that never saw the light of day.

Jacob Anderson

March 28, 2025 AT 04:20Oh, the paranoia is adorable-maybe the only thing more secret than the token’s roadmap is the amount of hype you’ll lose after the first month.

Charles Banks Jr.

March 28, 2025 AT 04:23Lock it, earn it, repeat.

Michael Wilkinson

March 28, 2025 AT 04:26Short and sweet, just like the returns you’ll see if you actually follow through on the lock‑up periods.

Billy Krzemien

March 28, 2025 AT 04:30If you’re new to staking, start with the 3‑month lock to test the waters. Keep your wallet secure, double‑check the contract address, and remember that rewards compound only when the platform’s liquidity remains healthy.

MD Razu

March 28, 2025 AT 04:33Consider the philosophical implications of locking your wealth in a token that promises a tangible asset-does this not echo the age‑old debate of materialism versus digital abstraction? Yet, from a practical standpoint, the longer the lock‑up, the higher the multiplier, which aligns incentives but also raises opportunity costs. If the platform’s governance evolves, you might find yourself tethered to decisions you never anticipated. Therefore, a balanced approach-perhaps a 6‑month period-offers a middle ground between reward and flexibility.

Lindsay Miller

March 28, 2025 AT 04:36The calculator is a useful tool, but it’s only as good as the data fed into it. Watch for updates on transaction fees and buyback volumes, as they can change the actual rewards you receive.

Katrinka Scribner

March 28, 2025 AT 04:40Love the idea of earning while waiting for a DeLorean! 😊 Just make sure you read the fine print so you don’t miss out on any hidden fees.

Waynne Kilian

March 28, 2025 AT 04:43Let’s keep the conversation constructive-if we all share sources and experiences, the community can help each other avoid pitfalls.

Rajini N

March 28, 2025 AT 04:46For anyone unsure about the lock periods, try a small stake first. Test the reward calculations, then decide if you want to increase your commitment based on the observed yields.

Kate Roberge

March 28, 2025 AT 04:50Honestly, I think the whole DMC thing is just another overhyped token trying to ride on nostalgia. You’ll probably see the price dip once the initial excitement fades.