Liquidity Impact Calculator

How Liquidity Affects Your Trades

Enter values to calculate price impact based on market liquidity depth. This tool demonstrates the relationship between order size, liquidity depth, and slippage as discussed in the article.

Use the 1% depth metric shown in the article, which represents the total volume needed to move the price 1% from the current mid-price. For example, if the 1% depth is $1,000,000, a $10,000 trade would move the price approximately 1%.

Ever wonder why a single large trade can send Bitcoin soaring or crashing? The answer often lies in cryptocurrency liquidity - how easily a digital asset can be moved without bulldozing its price. This article untangles the link between liquidity and price, walks through the mechanics that traders see daily, and shows what to watch when markets shift.

What Liquidity Really Means in Crypto

Liquidity is the ease with which a digital asset can be bought or sold without causing large price changes. In a liquid market, a $10million buy order will barely nudge the price; in a thin market, that same order can swing the price by several percent. Liquidity isn’t a single number - it’s reflected in order‑book depth, trading volume, and the number of venues where the asset trades.

Liquidity’s Direct Impact on Price Volatility

When liquidity dries up, price volatility spikes. Research from 2021 (COVID‑19 pandemic) showed that markets with shrinking depth experienced larger daily swings, while those that attracted fresh capital saw volatility melt away. Bitcoin, Ethereum, Litecoin, and Cardano have historically shown “stable” liquidity patterns, meaning their price swings stay relatively modest even after big trades. In contrast, Bitcoin Cash and Bitcoin SV proved vulnerable - a sudden drop in depth translated into wild price swings within minutes.

Order‑Book Depth and Market‑Depth Bands

The order book is a snapshot of all buy and sell orders at various price levels. The deeper the book, the smaller the price impact of a given order. A common metric is the 1% depth - the total volume needed to move the price 1% away from the mid‑price. On Binance, the BTC‑USDT pair routinely shows 1% depth of over US$15million, while EUR‑USDC sits near the bottom with just a few hundred thousand dollars. This disparity explains why crypto‑USDT pairs stay calm while crypto‑fiat pairs can jitter during news spikes.

Centralized vs. Decentralized Exchanges: Liquidity Profiles

Liquidity fragmentation - the scattering of order flow across many venues - blurs price discovery. Centralized exchanges (CEX) like Binance or Kraken host deep order books because market makers post limit orders. Decentralized exchanges (DEX) rely on automated market makers (AMM) that price assets via a constant‑product formula. The result?

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Liquidity source | Order‑book based market makers | Liquidity pools (LP tokens) |

| Depth measurement | Order‑book depth (1% & 10% bands) | Pool size & slippage curve |

| Price impact | Linear with order size | Non‑linear, rises sharply after 0.3% of pool |

| Fragmentation risk | High across many CEXs | Higher due to many independent pools |

| Regulatory exposure | Subject to KYC/AML | Typically permission‑less |

Because DEX pools price assets via formulas, a modest trade can generate noticeable slippage when the pool is small. In contrast, a deep CEX order book can absorb the same trade with barely any price move.

Market‑Making Incentives and Liquidity Mining

Market‑making incentives are rewards or fee rebates offered to participants who provide buy and sell orders, thereby deepening the order book. Exchanges like Bybit and Binance hand out rebates, rebate‑plus‑rebate, or even native token rewards for placing limit orders. A February2025 study found that incentive‑driven market making boosts 1% depth by up to 30% and cuts volatility during stress periods.

Liquidity mining is the practice of rewarding users with protocol tokens for depositing assets into a liquidity pool. While liquidity mining can flood a DEX pool with capital, the quality of that liquidity depends on the reward design. Over‑generous rewards can attract “cheaper” capital that exits quickly, causing depth to evaporate when markets turn sour.

External Events That Shock Liquidity

Major news can instantly thin markets. During the Silicon Valley Bank crisis (Mar2023), USDC‑USD order books on Kraken showed a dramatic gap: at the 1% level, executable volume fell to near‑zero, while the 10% level still had ample depth. The result was wild price swings for anyone trying to move more than a few hundred thousand dollars.

Security breaches also rip liquidity. The Feb212025 Bybit hack stole $1.4bn of ETH, spiking trade volume on the day of the breach but halving it in the following week as confidence sank. Traders who rely on a single exchange can face sudden liquidity droughts, which translates into price volatility and wider spreads.

Regulatory Influence on Liquidity Provision

Regulators are beginning to shape how liquidity can be offered. Policies that impose strict capital‑reserve requirements on market makers can unintentionally choke depth, while frameworks that encourage transparent fee rebates tend to attract more stable liquidity. The February2025 research highlighted that well‑designed incentive structures, backed by clear regulatory guidance, can improve price stability without fostering manipulative practices.

Future Trends: Institutional Entry and Corporate Liquidity Management

Institutional players bring huge order books. As more corporates add crypto to treasury‑management tools (Kyriba 2025 report), the aggregate market depth is set to rise, reducing price impact for large trades. Yet, this influx also introduces new risk vectors - corporate risk‑management policies may impose withdrawal windows, temporarily throttling liquidity during market stress.

Technological upgrades - faster matching engines, cross‑chain bridges, and unified liquidity aggregators - aim to shrink fragmentation. By pooling order flow from dozens of venues, aggregators can present a single deep order book, smoothing price curves across the ecosystem.

Key Takeaways for Traders and Investors

- Monitor 1% and 10% depth on your primary exchange - shallow depth = higher slippage.

- Watch incentive announcements (rebates, liquidity‑mining programs) as they often precede liquidity spikes.

- Diversify across CEX and DEX venues to avoid single‑point liquidity failures.

- Stay alert to macro events (bank failures, hacks) that historically thin order books.

- Consider regulatory news - tighter rules can dampen market‑making activity.

Quick Checklist for Managing Liquidity Risk

- Identify the top three venues where your asset trades the most volume.

- Record the 1% and 10% depth for each venue daily.

- Set a slippage tolerance (e.g., 0.5%) and avoid orders that exceed the depth at that tolerance.

- Track incentive changes - add them to your risk‑monitoring dashboard.

- Maintain a backup venue with at least 30% of your primary venue’s depth.

Frequently Asked Questions

What is the difference between liquidity and volume?

Volume measures how much of an asset trades in a given period, while liquidity reflects how easily a trade can be executed at the current price. High volume does not guarantee high liquidity if orders concentrate at a few price levels.

How can I tell if an order book is thin?

Check the 1% depth. If the total buy or sell volume needed to move the price 1% is less than 1‑2% of the asset’s daily volume, the book is considered thin and price impact will be high.

Do liquidity‑mining rewards improve price stability?

Short‑term, yes - they attract capital and deepen pools. Long‑term stability depends on token economics; if rewards stop, liquidity can evaporate, re‑introducing volatility.

Why do crypto‑USDT pairs have deeper markets than crypto‑fiat pairs?

USDT trades on‑chain without banking compliance, allowing faster settlement and lower fees. Fiat pairs require KYC, AML, and banking integration, which add friction and thin the order book.

Can regulation hurt liquidity?

Overly strict capital‑reserve rules can limit market‑maker participation, reducing depth. Balanced regulation that encourages transparent rebates tends to support healthy liquidity.

Cynthia Chiang

October 13, 2025 AT 08:25Liquidity is the lifeblood of any crypto market, and understanding it can save you from painful slippage.

When you place a large order on a thinly traded coin, the price will wander until enough counterparties fill the gap.

This price wander is what we call market impact, and it is directly proportional to the order size relative to the 1% depth metric.

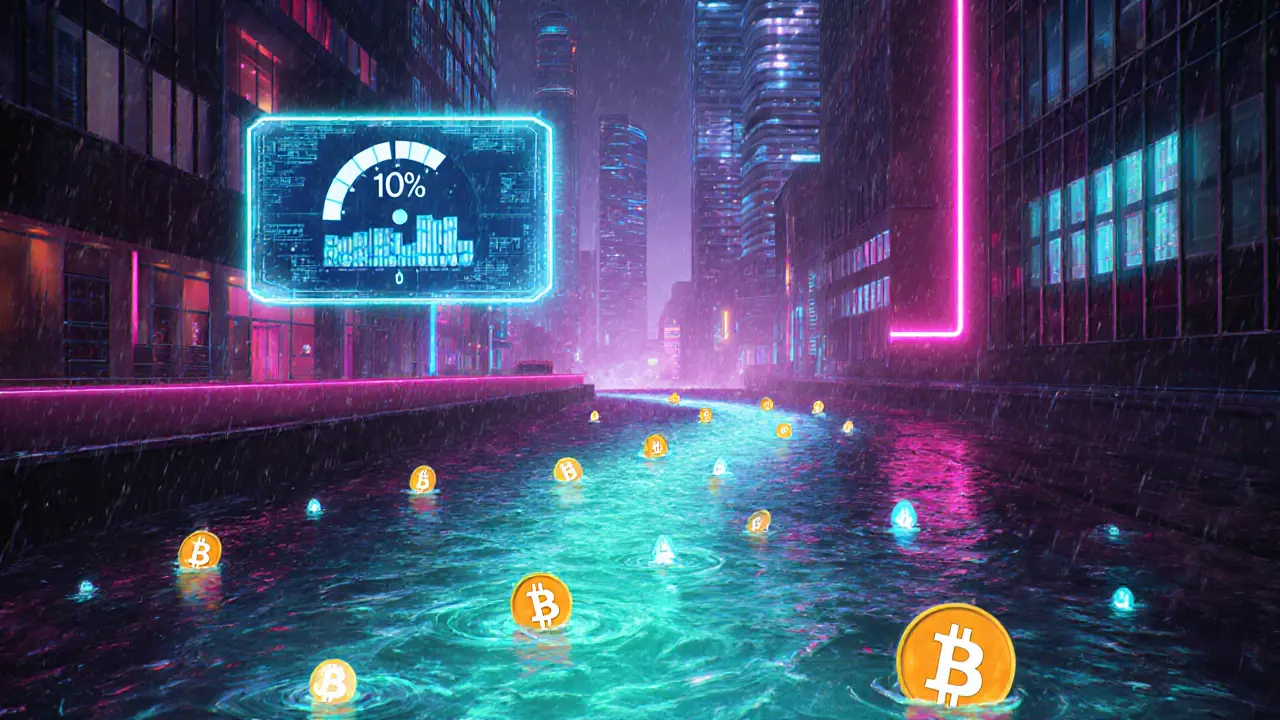

Think of the 1% depth as a reservoir: the deeper the reservoir, the more water (capital) you can pour without flooding the banks.

A shallow depth means even a modest trade can cause the price to shift noticeably, hurting both you and other traders.

The calculator in the article visualizes this by takign the current price, the 1% depth, and your order size to estimate slippage.

If the estimated slippage is high, you might consider splitting your order into smaller chunks or using limit orders.

Splitting helps you stay within the market’s natural liquidity bands and reduces the chance of triggering a cascade of stop‑losses.

Some exchanges also offer iceberg orders that hide the true size of your trade, further protecting you from visible impact.

Remember, liquidity is not static; it fluctuates with time of day, news events, and even the sentiment of the community.

During a bull run, fresh capital often flows in, temporarily deepening the market, while a sudden crash can evaporate liquidity overnight.

This dynamic nature is why it’s crucial to monitor the order book and recent volume before committing large sums.

Beginners often overlook these nuances and end up paying more in fees and lost value than they anticipated.

By staying aware of the depth and using tools like the impact calculator, you can make more informed decisions.

Moreover, diversifying across multiple exchanges can give you access to deeper pools of liquidity, further smoothing your trades.

So next time you think about a big buy or sell, pause, check the depth, and let the data guide your move.

Hari Chamlagai

October 23, 2025 AT 00:25The market, like any living organism, seeks equilibrium, and liquidity is its pulse.

When you ignore the underlying depth, you are essentially swimming against a current you cannot see.

This is not merely a trading error; it's a philosophical misstep that defies the rational order of markets.

The 1% depth metric provides a concrete anchor, yet many treat it as an afterthought, as if advice were optional.

By treating liquidity as a measurable constraint, you elevate your strategy from guesswork to disciplined execution.

Ignorance of slippage is a self‑inflicted wound that will bleed you dry over time.

Therefore, respect the numbers, calibrate your position size, and let the data dictate your moves.

Anything less is intellectual laziness.

Ben Johnson

November 1, 2025 AT 15:25Looks like someone's finally discovered the magic of liquidity, huh?

Yeah, the deeper the order book, the less your trade looks like a wrecking ball.

If you think you can dump a million bucks on a low‑cap coin without moving the price, good luck with that fantasy.

The calculator in the post is a reality check you didn't ask for.

So maybe, just maybe, think twice before you cry about slippage.

Jason Clark

November 11, 2025 AT 07:25Liquidity depth is simply the cumulative volume needed to shift the mid‑price by a given percentage, typically 1%.

The article defines this as the "1% depth" and uses it as a baseline for impact calculations.

If your order size equals 10% of that depth, expect roughly a 10% price movement, all else being equal.

This assumes linearity, which in real markets holds only for modest trades.

So, use the calculator to gauge whether your order is reasonable, or if you need to split it into smaller slices.

Jim Greene

November 20, 2025 AT 23:25Wow, this tool is a game‑changer for anyone wanting to stay ahead of the curve! 🚀 Understanding liquidity helps you avoid nasty surprise slippages that can eat into your gains.

The visual calculator makes it super easy to see how big a trade you can safely pull off.

If the slippage badge lights up green, you’re good to go; yellow means tread carefully, and red-well, it’s a sign to rethink.

Keep an eye on the 1% depth, and you’ll feel way more confident when the market gets volatile.

Happy trading, and may your profits be as smooth as butter! 😊

Steve Cabe

November 30, 2025 AT 15:25The United States crypto markets benefit from deep liquidity thanks to our robust financial infrastructure.

When traders ignore this advantage, they often blame volatility on external forces, which is simply misguided.

The 1% depth metric shows how much capital is truly available, and in our market it consistently outperforms many overseas exchanges.

If you want to minimize slippage, leverage the depth we naturally possess, rather than fleeing to ill‑liquid venues.

Remember, a strong domestic market protects American investors from unnecessary risk.

Wayne Sternberger

December 10, 2025 AT 07:25Dear fellow enthusiast,

It is my pleasure to address the nuances of market liquidity in a respectful manner.

Liquidity, as defined, represents the ease with which an asset can be bought or sold without causing excessive price changes.

One must attentively examine the order book depth to assess potential slippage.

The calculator offered herein serves as a valuable instrument for such analysis.

I encourage you to recive the data thoughtfully and apply it to your trading decisions.

Should you require further guidance, kindly keep the discourse ongoing.

Sincerely, your supportive coach.

Gautam Negi

December 19, 2025 AT 23:25In a world where everyone praises deep liquidity as a universal boon, I must offer a dissenting perspective.

While abundant liquidity can cushion trades, it also invites large speculative flows that destabilize price discovery.

The very metric of 1% depth, when overly large, may mask hidden fragilities that surface under stress.

Moreover, excessive depth can lull traders into a false sense of security, prompting them to overextend.

Thus, one should not merely chase depth, but also consider market resilience and distribution of orders.

In times of sudden market shocks, even a deep book can evaporate, leaving thin liquidity behind.

Therefore, balance is paramount, and vigilance should never be abandoned.

Shauna Maher

December 29, 2025 AT 15:25The real reason you see high slippage isn’t just low liquidity-it's the hidden hands manipulating order books behind the scenes.

Shadowy entities pump and dump, deliberately thinning the market to profit from unsuspecting traders.

When you rely on tools like this calculator, you’re still playing into their game if you don’t question who’s setting the depth numbers.

Trust no single data source, and always assume there’s an agenda at work.

Protect yourself by diversifying exchanges and never give them the satisfaction of watching you panic over slippage.

Kyla MacLaren

January 8, 2026 AT 07:25Hey team, just wanted to add my two cents on the liquidity topic.

I think we all agree that checking the 1% depth before a big trade is a smart move.

The calculator makes it easy, but don’t forget to also look at recent volume trends-those can change fast.

If anyone has tips on splitting orders efficiently, please share, we can all learn together.

Let’s keep the discussion friendly and helpful!

Linda Campbell

January 17, 2026 AT 23:25Esteemed colleagues, I wish to underscore the strategic importance of domestic liquidity for our nation's crypto ecosystem.

A deep order book anchored by American investors provides stability that foreign markets often lack.

When the calculation indicates minimal slippage, it reinforces the superiority of our infrastructure.

Conversely, reliance on external platforms exposes us to unnecessary volatility and regulatory uncertainty.

Therefore, prioritizing trades within robust US exchanges aligns with national economic interests.

John Beaver

January 27, 2026 AT 15:25Folks, if you’re scratching your head about how the impact calculator works, let me break it down.

First, plug in the current price, then the 1% depth value from the article, and finally your intended order size.

The tool will spit out an estimated slippage percentage, giving you a quick sense of market impact.

If the number looks high, consider chopping up your order or using limit orders to get a better fill.

Also, keep an eye on recent trading volume-it can shift the depth faster than you think.

Hope this helps you navigate the markets with more confidence.

Jazmin Duthie

February 6, 2026 AT 07:25Liquidity is just a fancy word for how fast you can sell.

Della Amalya

February 15, 2026 AT 23:25Friends, let’s take a moment to appreciate how liquidity shapes our trading journeys.

It’s not just a cold number-it’s the pulse that determines whether our ambitions glide or grind.

When you see the 1% depth glowing green, imagine a calm river carrying your trade downstream effortlessly.

A yellow glow hints at eddies; navigate carefully, perhaps by splitting your order into smaller streams.

Red warns of roaring rapids-time to reconsider or find a wider channel.

Remember, every trader, from novice to veteran, can harness these insights to protect their capital.

Use the calculator as a lantern in the dark, illuminating hidden costs before you step forward.

Together, we can turn complex market mechanics into approachable strategies.

Stay curious, stay safe, and let the data guide your path.