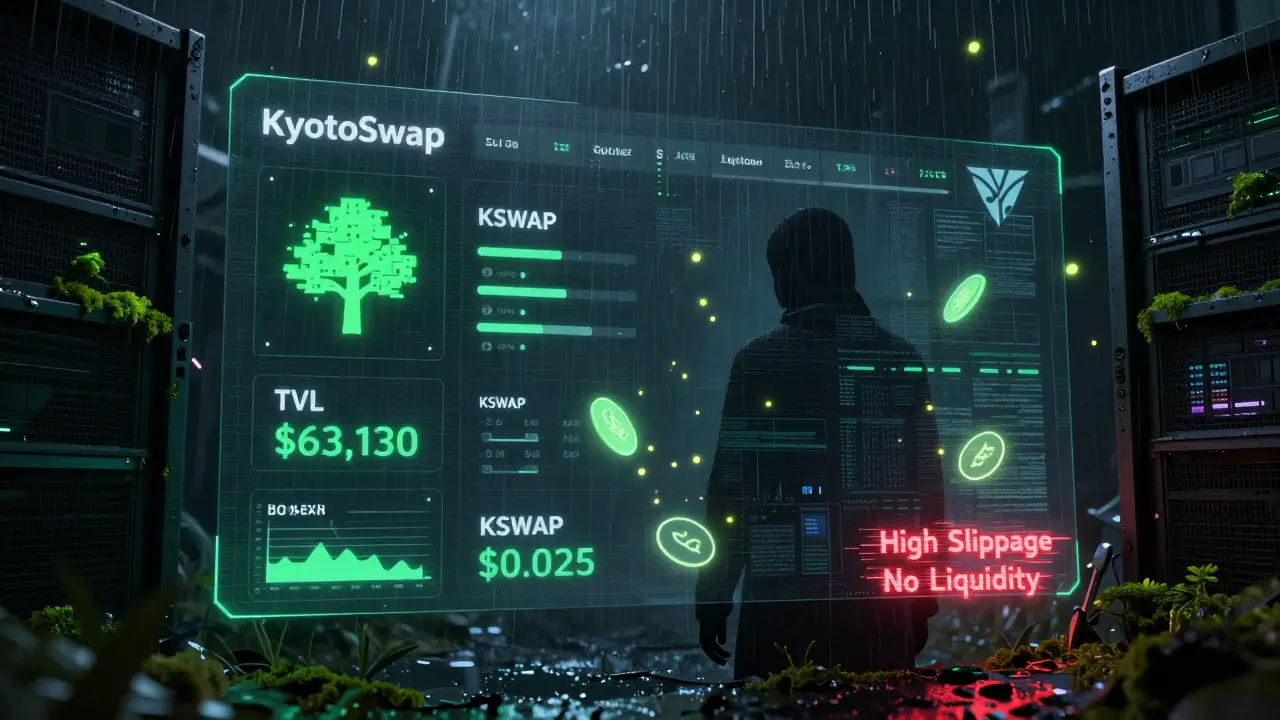

When you hear about a crypto exchange that plants trees every time you trade, it sounds too good to be true. That’s KyotoSwap. Launched on the BNB Smart Chain, it’s marketed as the first decentralized exchange (DEX) that turns liquidity provision into real-world environmental action. But here’s the reality: as of January 2026, KyotoSwap has a total value locked (TVL) of just $63,130. Its native token, KSWAP, trades under $0.05, with daily volume often under $50. You’re not just dealing with a small project-you’re dealing with one that’s barely alive.

What KyotoSwap Actually Does

KyotoSwap isn’t a centralized exchange like Binance or Coinbase. It’s a decentralized exchange built on the BNB Smart Chain, using an Automated Market-Maker (AMM) model-just like Uniswap or PancakeSwap. You connect your wallet, swap tokens, and earn KSWAP rewards for providing liquidity. The twist? For every KSWAP you earn, the platform claims to plant a tree through its partner, Veritree. That’s the whole selling point: crypto that grows forests.

The tokenomics are simple: 750 million KSWAP tokens max supply. Only about 174,000 are circulating, according to CoinMarketCap. That’s a tiny fraction. The token peaked at $2.40 in March 2023. Today, it’s trading at around $0.025 to $0.05, depending on which data source you trust. That’s a 99% drop from its high. If you bought at the top, you’d need a miracle to break even.

The Tree-Planting Promise-Real or Just Marketing?

The environmental angle is KyotoSwap’s only real differentiator. Most DEXs compete on speed, fees, or features. KyotoSwap tries to compete on conscience. It says every time you provide liquidity to a KSWAP/WBNB pair, you trigger a tree planting. The platform even has an "Impact Leaderboard" showing who’s planted the most trees.

But here’s the problem: no one can independently verify it. Veritree is a legitimate company that tracks reforestation projects. But KyotoSwap doesn’t publish receipts-no blockchain-verified proof of planting, no geotagged photos, no third-party audit of tree survival rates. Users on Reddit say they’ve been using the platform for months and still haven’t seen a single tree credited to their account. One user wrote: "I’ve earned 12,000 KSWAP. The app says I planted 12 trees. But I’ve never received a confirmation email, a photo, or even a map link. How do I know it’s real?"

Without transparency, the tree-planting feature feels like a gimmick. It’s not fraud-yet-but it’s not proof either.

Trading on KyotoSwap: A Risky Experience

If you’re thinking of swapping tokens on KyotoSwap, prepare for friction. Total liquidity across all trading pairs is under $24,000. That’s less than what a single popular meme coin pair on PancakeSwap holds. Low liquidity means one thing: massive slippage.

Try swapping $50 of BNB for KSWAP? You might get a 15% price hit before the trade even confirms. That’s not normal. On Uniswap or PancakeSwap, slippage under 1% is standard. On KyotoSwap, users report needing to set slippage tolerance to 10-15% just to get their trades through. That’s not trading-it’s gambling on price movement.

There are no limit orders. No advanced charting tools. No stop-losses. No mobile app. The interface is basic, clunky, and slow. It looks like it was built in 2021 and never updated. The official documentation is minimal. The Telegram group has 187 members. Most posts are questions like, "Why won’t my trade go through?" or "Is this exchange still running?"

How KyotoSwap Compares to the Big Players

Let’s put this in perspective. PancakeSwap, the biggest DEX on BNB Smart Chain, has over $1.5 billion in TVL. KyotoSwap has $63,130. That’s 24,000 times smaller. Uniswap, the global leader, has over $3 billion. KyotoSwap’s market cap? Around $4,400. That’s less than the cost of a used bicycle.

And it’s not just size. PancakeSwap has yield farming, NFTs, prediction markets, launchpads, and a user base of millions. KyotoSwap has one feature: swapping tokens and planting trees. No one’s building on it. No devs are adding new tokens. No partnerships. No updates since October 2025. The GitHub repo hasn’t seen a commit in months.

If you’re looking for a DEX to use daily, KyotoSwap isn’t it. It’s not even a backup option. It’s a curiosity.

Who Should Even Consider Using KyotoSwap?

There are only two types of people who might find value here:

- People who want to support the idea of green crypto-even if the impact is unverified. If you believe in the concept and don’t mind risking your capital on a long shot, this might be your way to signal support.

- Speculators chasing a potential rebound-but that’s extremely risky. With a 99% drop from its peak, low volume, and no signs of recovery, this isn’t a "buy the dip" situation. It’s a "wait and see if it dies" situation.

Everyone else should avoid it. If you’re new to DeFi, stick with PancakeSwap or Uniswap. If you’re an experienced trader, you know liquidity matters. KyotoSwap doesn’t have any. And if you’re looking to earn yield, there are hundreds of safer, higher-volume farms on BNB Chain.

The Bottom Line: A Noble Idea, a Failing Project

KyotoSwap had a great idea: make crypto eco-friendly by tying token rewards to real-world reforestation. That’s not just clever-it’s needed. The crypto industry is under fire for its energy use. Projects that actually reduce environmental harm deserve attention.

But good intentions don’t build products. Good execution does.

KyotoSwap failed at execution. Low liquidity. No updates. No transparency. No user growth. No community. And no path forward. The team hasn’t released a roadmap update in over three months. The token is practically dead. The tree-planting feature might be real, but without proof, it’s just a story.

If you want to support green crypto, find a project with traction, audits, and verifiable impact. KyotoSwap isn’t it. Right now, it’s a ghost in the DeFi landscape-a quiet, fading echo of a better idea.

Is KyotoSwap safe to use?

KyotoSwap runs on the BNB Smart Chain, which is secure and widely used. But safety isn’t just about the chain-it’s about the project. There’s no public audit of KyotoSwap’s smart contracts, and the team is anonymous. With such low liquidity, your funds are at risk of being trapped if no one else trades. Also, slippage can eat up your capital fast. Use only what you can afford to lose.

Can you actually earn money trading KSWAP?

It’s extremely unlikely. KSWAP has lost over 98% of its value since its peak. Daily trading volume is under $50. That means almost no one is buying or selling. Even if you buy low, there’s no one to sell to. The only way to "earn" is by providing liquidity and earning KSWAP rewards-but those rewards are worth pennies, and the risk of impermanent loss still exists despite claims otherwise. Don’t count on this as an income source.

Does KyotoSwap really plant trees?

KyotoSwap claims it does, through a partnership with Veritree. But there’s no public proof-no blockchain records, no photos, no location data, no tree IDs. Users report no confirmation after earning hundreds of KSWAP. While Veritree is a real company, KyotoSwap hasn’t shown how it connects its token activity to actual planting. Until transparency improves, treat this as a marketing claim, not a verified fact.

How do I buy KSWAP?

You need a Web3 wallet like MetaMask or Binance Web3 Wallet. Connect it to the KyotoSwap website, then swap BNB, USDT, or another supported token for KSWAP. Be warned: slippage will be high. Set your tolerance to at least 10-15%. Trade small amounts-under $20-if you want to avoid losing value to price impact. There’s no centralized listing, so you can’t buy KSWAP on Binance or Coinbase.

Is KyotoSwap going to survive?

Based on current data, it’s unlikely. Projects with TVL under $100,000 have a 97.3% failure rate within 18 months, according to Messari’s 2026 report. KyotoSwap has no active development, no marketing, and no user growth. Its only advantage-the tree-planting feature-isn’t enough to draw attention in a crowded DeFi space. Unless a major investor or partner steps in soon, it will likely fade into obscurity within the next year.

Jessica Boling

January 24, 2026 AT 22:01MOHAN KUMAR

January 26, 2026 AT 18:04Jennifer Duke

January 26, 2026 AT 22:15Abdulahi Oluwasegun Fagbayi

January 28, 2026 AT 00:11Andy Marsland

January 29, 2026 AT 13:51Anna Topping

January 30, 2026 AT 22:08Jeffrey Dufoe

February 1, 2026 AT 17:15Tselane Sebatane

February 2, 2026 AT 06:44Jen Allanson

February 3, 2026 AT 21:16Dave Ellender

February 5, 2026 AT 04:14Linda Prehn

February 6, 2026 AT 10:28Adam Lewkovitz

February 6, 2026 AT 19:47Arnaud Landry

February 8, 2026 AT 14:34george haris

February 9, 2026 AT 21:50Athena Mantle

February 11, 2026 AT 11:31Paru Somashekar

February 12, 2026 AT 13:50Steve Fennell

February 12, 2026 AT 16:32HARSHA NAVALKAR

February 13, 2026 AT 17:55Kevin Pivko

February 14, 2026 AT 16:38