When Bitcoin’s block reward cuts in half, it’s not just a ceremonial event for investors-it’s a survival test for miners. The April 2024 halving slashed rewards from 6.25 BTC to 3.125 BTC per block overnight. For many miners, that wasn’t a headline. It was a death sentence.

Why Miner Capitulation Happens

Miner capitulation isn’t a crash. It’s a quiet exodus. It happens when the math no longer works. Before the halving, a miner with a 100 TH/s ASIC rig might’ve earned $50 a day. After? That same rig now earns $25. But their electricity bill? Still $40. Suddenly, they’re losing $15 a day. No profit. No future.

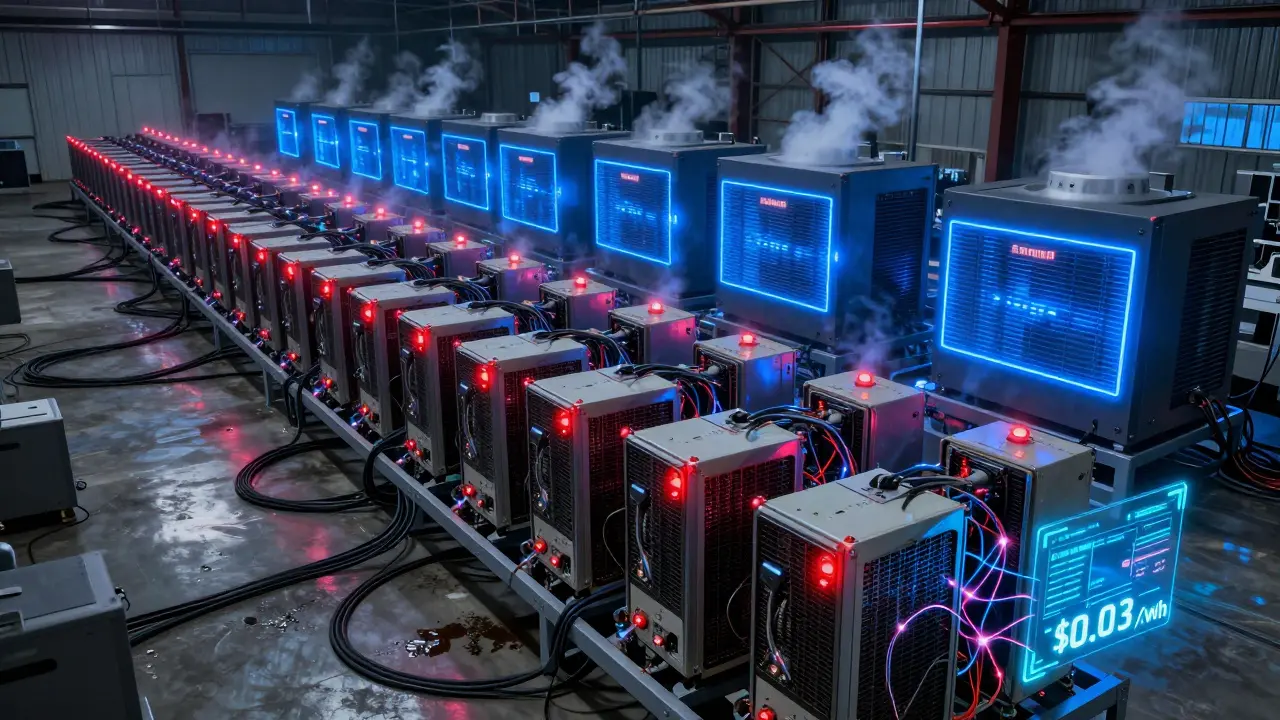

This isn’t theoretical. In the weeks after the 2024 halving, hundreds of small mining operations shut down. They didn’t have the cash to wait. They didn’t have access to cheap power. And they sure as hell weren’t running the latest ASIC chips. The ones that survived? They were already running on hydroelectric power in Kazakhstan, or had locked in $0.03/kWh contracts in Texas. Everyone else? They unplugged.

The Real Cost of Mining

Electricity isn’t just an expense-it’s the entire game. Miners who pay $0.08/kWh or more are already on borrowed time. The break-even point after the 2024 halving? Around $54,000 per Bitcoin. If the price doesn’t rise fast enough, miners with inefficient gear vanish.

Here’s what efficiency looks like in practice:

- Old ASICs (Antminer S19): 95 TH/s at 3,250W → 29.2 TH/s per kW

- New ASICs (Bitmain S21): 200 TH/s at 5,400W → 37.0 TH/s per kW

That 27% jump in efficiency isn’t a luxury. It’s the difference between profit and bankruptcy. A miner running 100 S19s might’ve made $5,000/month pre-halving. Post-halving? $2,500. But if they upgrade to 50 S21s, they still make $3,800-even with the same electricity cost. That’s why the biggest mining firms are replacing entire farms in months, not years.

Who Survives? Who Doesn’t

Not all miners are created equal. The ones that vanished after April 2024? Usually:

- Individuals mining in garages with retail electricity

- Miners using 2020-2022 hardware (S17, S19, T19)

- Operations in countries with unstable grids or high tariffs (like parts of South America or Southeast Asia)

- Those without cash reserves to last 6+ months

Meanwhile, the survivors? They’re industrial. Companies like Marathon Digital, Bitdeer, and Riot Platforms didn’t just survive-they bought up the wreckage. They snapped up used ASICs from failed farms at 40% off. They signed long-term deals with wind and solar farms in Texas and Scandinavia. They even started using waste heat from mining to warm greenhouses. They turned a crisis into a competitive edge.

The Hash Rate Drop and Network Resilience

After each halving, Bitcoin’s total hash rate drops. After April 2024, it fell by 18% in the first 60 days. That sounds scary-until you realize the network adjusted. Every two weeks, Bitcoin automatically lowers the mining difficulty to match the remaining hash power. By August 2024, difficulty had dropped 22%. That meant the miners who stayed in the game started earning more again-not because Bitcoin rose, but because fewer people were competing.

This is the hidden design of Bitcoin. Halving doesn’t just reduce supply-it filters out weak players. The network gets leaner. More secure. Less centralized around a few giant pools. The miners who leave? They’re not failures. They’re part of the system working as intended.

How Miners Adapt

Surviving isn’t about hoping Bitcoin goes up. It’s about three hard choices:

- Upgrade hardware-You need at least 30 TH/s per kW to stay alive. Anything below 25 TH/s per kW is a money pit after halving.

- Lock in cheap power-Direct contracts with renewable providers beat retail rates every time. Some miners now pay $0.02/kWh by tapping into surplus hydro from dams.

- Keep cash reserves-The best-run operations keep 8-12 months of operating costs in Bitcoin or USD. No debt. No panic.

Some are even adding new revenue streams. Mining pools now offer transaction fee optimization tools. A few are integrating with Bitcoin Layer-2 networks like the Lightning Network, earning small fees on off-chain transactions. It’s not enough to replace block rewards-but it helps bridge the gap.

What Comes Next?

The next halving is in 2028. By then, over 97% of all Bitcoin will be mined. The remaining 650,000 coins will be harder to find. That means even more pressure on miners. The industry is already shifting toward oligopoly. A handful of firms with access to renewable energy, ultra-efficient hardware, and global scale will dominate. The rest? They’ll either join them or disappear.

Some say this is bad for decentralization. But Bitcoin’s design doesn’t care about your ideals. It cares about math. And the math says: only the most efficient survive. The rest? They get filtered out. Again. And again. And again.

What You Should Know

If you’re thinking about mining Bitcoin today:

- Don’t buy used S19s unless you’re getting them for under $500 each-and even then, calculate your electricity cost first.

- If your power bill is above $0.05/kWh, mining is a gamble, not a business.

- Cloud mining services? Avoid them. Most are scams or overpriced rentals.

- Wait for the next halving to pass before investing. The first six months after are the deadliest.

If you’re holding Bitcoin? Don’t panic when miners shut down. That’s not a sign of weakness. It’s the system working. The network is getting stronger. The supply is getting scarcer. And the miners who remain? They’re the ones who built Bitcoin’s foundation.

What exactly is miner capitulation?

Miner capitulation is when Bitcoin miners shut down operations because they can no longer cover costs after the block reward is cut in half. It’s not a sudden collapse-it’s a slow, painful exit by the least efficient operators, usually within 3-6 months after a halving.

How much does electricity cost for a miner to stay profitable?

To survive post-halving, miners need electricity below $0.05 per kWh. The most successful operations pay $0.03 or less-often through direct deals with renewable energy providers. Anything above $0.08/kWh makes mining unprofitable unless Bitcoin’s price surges dramatically.

Do all miners lose money after a halving?

No. Only the inefficient ones. Well-funded mining firms with modern ASICs and low-cost power often see increased profits after halving because their competitors disappear, and network difficulty drops. Some even profit from buying up the hardware of failed operations at steep discounts.

Why does Bitcoin’s difficulty adjust after a halving?

Bitcoin adjusts mining difficulty every 2,016 blocks (about two weeks) to keep block production stable at roughly one every 10 minutes. When miners shut down after a halving, the total hash rate drops. Lower difficulty means the remaining miners can find blocks more easily, helping them regain profitability without needing Bitcoin’s price to rise immediately.

Is cloud mining a good way to avoid capitulation?

No. Most cloud mining services are overpriced, lack transparency, or outright scam users. You’re paying for someone else’s hardware and electricity, and you have zero control over the equipment. If the market turns, they can stop payouts without warning. Real mining means owning your hardware and managing your energy costs.

Will Bitcoin mining become dominated by big companies?

Yes, and that’s by design. Bitcoin’s protocol rewards efficiency, not participation. As halvings continue, only those with access to ultra-cheap renewable energy and cutting-edge ASICs can survive. This naturally leads to consolidation. But it also makes the network more secure, because fewer, well-capitalized operators are less likely to shut down suddenly.