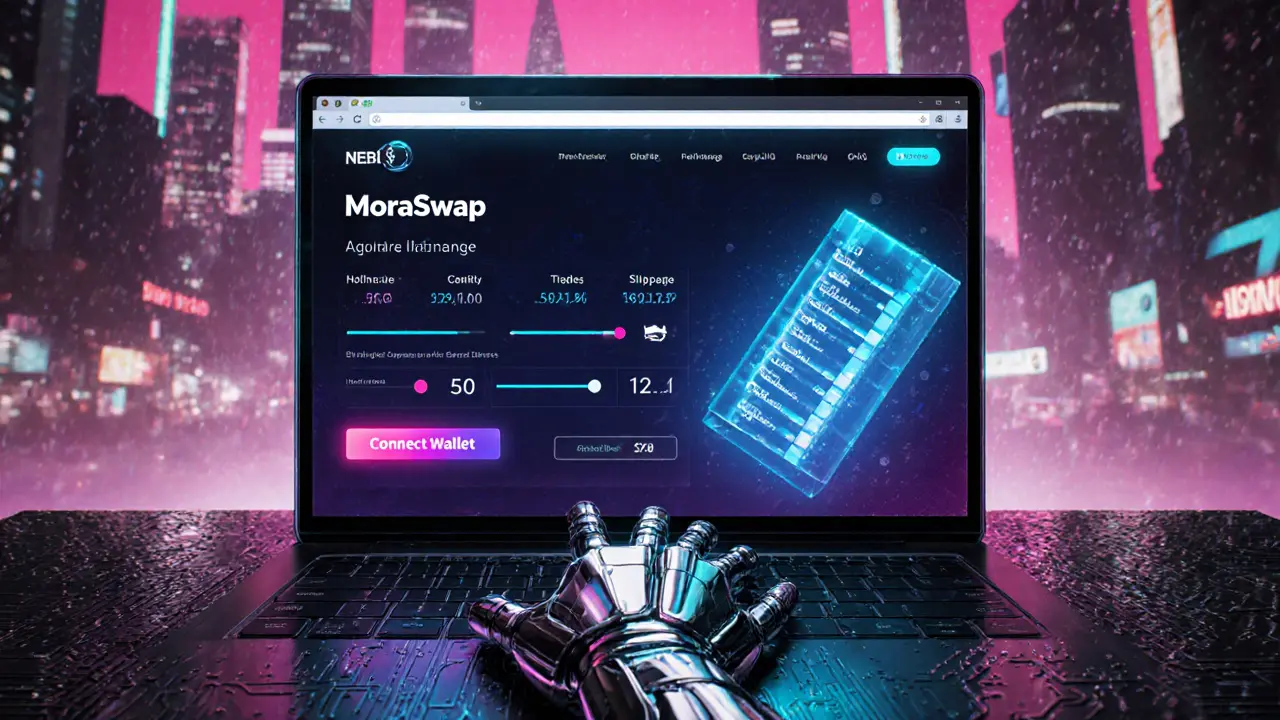

MoraSwap Fee Calculator

Estimate your potential trading costs on MoraSwap. Adjust parameters below to see how fees and slippage affect your trades.

Estimated Trade Costs

Trading Fee: $0.00

Slippage Cost: $0.00

Total Estimated Cost: $0.00

About MoraSwap

MoraSwap is a decentralized exchange operating with an AMM model. It charges competitive fees between 0.25% and 0.30% per swap. Liquidity may be limited on lower-volume pairs.

Note: This calculator provides estimates only. Actual costs may vary based on market conditions and pool dynamics.

TL;DR

- MoraSwap is a niche DEX that runs an AMM model with modest daily volume (~$0.56M).

- No official security audit is public, so treat it as higher‑risk.

- Fees are competitive (0.25%-0.30% per swap) but liquidity can be thin on less‑popular pairs.

- Interface is web‑based; you need a supported wallet (MetaMask, Trust Wallet, etc.).

- Best for traders who want to experiment with low‑cap tokens and are comfortable with DeFi risk.

What is MoraSwap?

MoraSwap is a decentralized exchange (DEX) that uses an automated market maker (AMM) model to let users trade tokens directly from their wallets. It launched in early 2024 and operates through a simple web portal at moraswap.com. Unlike centralized platforms, it does not hold user funds; trades are executed by smart contracts on the underlying blockchain.

How the AMM Model Works on MoraSwap

The platform’s core is an Automated Market Maker (AMM) that maintains liquidity pools for each token pair. When you swap TokenA for TokenB, you’re interacting with a smart contract that balances the pool based on a constant‑product formula (x·y=k). This eliminates order books and lets trades happen instantly, but it also means you pay a small slippage fee that goes to liquidity providers.

Fees, Liquidity & Trading Volume

According to the latest on‑chain data (Oct2025), MoraSwap’s DEX volume sits around $564,630 per day, roughly 13BTC. Spot volume is negligible (<$68). The fee structure is straightforward:

- Standard swap fee: 0.25% of the transaction value.

- Additional protocol fee (if any): 0.05% (currently not levied).

- Liquidity provider (LP) reward: the collected fees are redistributed to LPs in proportion to their share.

Because the platform is small, deep liquidity exists mainly for popular pairs like ETH/USDC or BNB/USDT. Niche tokens can suffer from high price impact, so always check the slippage preview before confirming.

Security Considerations

One red flag is the lack of a publicly available security audit. Most reputable DEXs (Uniswap, SushiSwap) publish audit reports from firms like Certik or PeckShield. MoraSwap’s smart contracts are open‑source on GitHub, but without third‑party verification you’re trusting the code you can read.

Other security aspects to watch:

- Smart Contract immutability means bugs can’t be patched without a governance vote.

- Rug‑pull risk is higher on low‑volume DEXes; always verify LP token contracts before depositing.

- Use a hardware wallet or a reputable mobile wallet with strong encryption.

User Experience & Onboarding

Getting started is similar to other web‑based DEXes:

- Open moraswap.com in a compatible browser.

- Click “Connect Wallet” and select your wallet (MetaMask, Trust Wallet, Coinbase Wallet, etc.).

- Choose the token pair you want to swap, enter the amount, and review slippage.

- Confirm the transaction in your wallet; the smart contract executes the swap.

The UI is clean but sparse-there’s no built‑in charting, order history, or advanced order types. For traders who need deeper analytics, you’ll have to rely on external tools like DEXTools or CoinGecko.

Comparison with Other DEXs

| Metric | MoraSwap | Uniswap | SushiSwap |

|---|---|---|---|

| Daily DEX Volume | $0.56M | $1.9B | $720M |

| Swap Fee | 0.25% (plus optional 0.05%) | 0.30% | 0.25% |

| Liquidity Pools (Top 5 Pairs) | Low‑mid depth | High depth, multiple incentives | Mid depth, some token‑specific farms |

| Audit Status | No public audit | Audited by Certik, PeckShield | Audited by Certik, Quantstamp |

| Community Size | ~1k Twitter followers | ~2M Discord members | ~800k Telegram users |

In short, MoraSwap is cheaper on paper but offers far less liquidity and security assurance. If you’re trading high‑volume assets, Uniswap or SushiSwap will give you better price stability.

Pros & Cons

Pros

- Simple web interface; no download required.

- Low swap fee compared to many DEXes.

- Supports a growing list of emerging tokens.

Cons

- No third‑party security audit - higher smart‑contract risk.

- Thin liquidity on many pairs leads to noticeable slippage.

- Limited community resources and documentation.

- Spot trading volume is virtually nil, so you can’t use it as a traditional exchange.

Is MoraSwap Worth Using?

If you’re comfortable navigating DeFi, enjoy hunting low‑cap tokens, and can tolerate the risk of an unaudited contract, MoraSwap can be a handy tool for quick swaps. For the average trader who values security and deep liquidity, sticking with larger DEXes or reputable centralized exchanges is safer.

Frequently Asked Questions

What blockchain does MoraSwap run on?

MoraSwap currently operates on the Ethereum mainnet and supports Binance Smart Chain through a cross‑chain bridge, allowing users to swap ERC‑20 and BEP‑20 tokens.

Do I need to pay gas fees to trade on MoraSwap?

Yes. Each swap triggers a smart‑contract call on the underlying blockchain, so you’ll pay the network’s gas fee (ETH on Ethereum, BNB on BSC) in addition to the platform’s swap fee.

Is there a way to become a liquidity provider on MoraSwap?

Yes. By depositing equal values of two tokens into a pool, you receive LP tokens that represent your share. Those tokens earn a portion of the swap fees collected by the pool.

How can I check if a token is listed on MoraSwap?

The exchange’s token list is displayed on the swap UI. You can also browse the repository on GitHub where the JSON token list is stored.

What should I do if a transaction fails?

Failed swaps usually revert automatically, but you’ll still be charged gas. Check your wallet's transaction history, increase the gas limit, and retry with a lower slippage tolerance.

Naomi Snelling

July 7, 2025 AT 19:11MoraSwap markets itself as a straightforward AMM DEX, yet the codebase hasn’t been audited by any reputable firm, which should set off alarms for anyone wary of hidden backdoors or subtle fee manipulations that could siphon funds under the guise of normal slippage.

Jacob Anderson

July 12, 2025 AT 10:18Those 0.25‑0.30% fees look "competitive" until you remember you’re also paying the hidden price of low liquidity and potential price impact on thin pools.

Carl Robertson

July 17, 2025 AT 01:25Imagine walking into a dimly lit hallway where every step you take is a gamble-MoraSwap’s liquidity on obscure pairs feels exactly like that, a high‑drama thriller where the villain is the dreaded impermanent loss.

Oreoluwa Towoju

July 19, 2025 AT 08:58For anyone diving in, start with well‑tracked pairs; keep trade sizes modest to avoid severe slippage.

Amie Wilensky

July 21, 2025 AT 16:31MoraSwap, a decentralized exchange, operates via smart contracts; however, the absence of a public audit, coupled with its modest daily volume, suggests a risk profile that cannot be ignored; users should therefore conduct thorough due diligence before allocating capital; the fee structure-0.25% to 0.30%-is indeed lower than many centralized platforms, yet the lack of depth may inflate effective costs.

Clint Barnett

July 25, 2025 AT 03:51When dissecting MoraSwap’s architecture, the first point to acknowledge is its reliance on an automated market maker model that, by design, eliminates order books but introduces a constant product formula which can be unforgiving to large trades; the second observation is the platform’s daily on‑chain volume, hovering around $560k, a figure that positions it well below the tier of established DEXes like Uniswap or SushiSwap, thereby signaling limited depth and heightened exposure to price impact; thirdly, the fee schedule-ranging from 0.25% to 0.30% per swap-does appear attractive on paper, but when you factor in the slippage that arises from shallow pools, the total cost can easily eclipse that nominal rate; fourth, there is a glaring omission of a publicly available security audit, a red flag for any prudent investor who knows that smart contract vulnerabilities are a prevalent threat in the DeFi ecosystem; fifth, the user interface, while clean and web‑based, still mandates a compatible wallet such as MetaMask, which introduces its own attack surface via phishing or extension exploits; sixth, liquidity providers on MoraSwap receive a share of the fees, but without substantial capital backing, their incentives may not compensate for the risk of impermanent loss, especially in volatile low‑cap token pairs; seventh, the platform’s governance token, if any, remains under‑discussed, leaving community participation and future roadmap visibility in shadows; eighth, the pricing oracle mechanisms are not elaborated upon, raising concerns about potential manipulation of asset valuations; ninth, cross‑chain compatibility is limited, restricting users to a single blockchain environment, which curtails arbitrage opportunities; tenth, the community support channels appear sporadic, offering minimal assistance during troubleshooting; eleventh, the transaction confirmation times are comparable to other Ethereum‑based DEXes, but during network congestion they can become prohibitively slow; twelfth, the gas fees inherent to the underlying blockchain can dominate the nominal swap fee for smaller trades; thirteenth, developers have not released a comprehensive whitepaper, making it difficult to assess long‑term sustainability; fourteenth, the platform’s code repository is public, yet the commit history shows infrequent updates, suggesting a slower development cadence; fifteenth, the lack of integration with popular DeFi aggregators means users cannot effortlessly source the best rates across multiple venues; finally, for risk‑averse participants, the combination of low volume, absent audit, and potential slippage renders MoraSwap a niche playground best suited for experimental traders comfortable with high‑risk DeFi experiments.

Charles Banks Jr.

July 26, 2025 AT 07:38So basically, if you enjoy watching your trade melt away into thin‑air, go ahead-MoraSwap is your ticket to that delightful disappointment.

Lindsay Miller

July 28, 2025 AT 15:11Just a heads‑up: always double‑check the token contract address before swapping; copy‑paste errors are a common way to lose funds.

Waynne Kilian

July 29, 2025 AT 18:58And remember, defi can be fun, but it also has its own set of traps-definately keep an eye on the gas fees.

Rajini N

August 1, 2025 AT 02:31MoraSwap’s fee calculator is handy for quick estimates, but actual outcomes will vary based on real‑time pool balances; a good practice is to test with a minimal amount first to gauge slippage.

Kate Roberge

August 2, 2025 AT 06:18Honestly, who needs another DEX that can’t even prove its code is safe? I’d rather stick with the big guys.

Jason Brittin

August 4, 2025 AT 13:51Cool tool, but don’t forget to keep your wallet secure 😎.

MD Razu

August 5, 2025 AT 17:38When we contemplate the ontological underpinnings of a platform like MoraSwap, we must ask whether the very notion of decentralization is being diluted by the opacity of its governance structures; the absence of a transparent audit trail invites speculation about the epistemic trust we place in the underlying code; furthermore, the economic incentives that drive liquidity provisioning are predicated on a fragile equilibrium between fee accrual and impermanent loss, a balance that is easily disrupted in low‑volume ecosystems; consequently, participants are compelled to navigate a labyrinth of hidden variables, each of which can alter the perceived value proposition; in this context, the advertised fee rate of 0.25% to 0.30% becomes a merely superficial metric, eclipsed by the deeper systemic risks inherent to the platform’s architecture.

VICKIE MALBRUE

August 7, 2025 AT 11:18Stay safe.

Michael Wilkinson

August 8, 2025 AT 15:05Keeping it simple is fine, but you’re ignoring the heavy‑handed reality that un‑audited contracts can be a nightmare for even the most careful users.

Billy Krzemien

August 10, 2025 AT 08:45True, so a balanced approach-small test trades, vigilant monitoring, and community feedback-offers the best path forward for anyone curious about MoraSwap.