When you hear "crypto exchange," you probably think of Uniswap, SushiSwap, or even centralized giants like Binance. But what about Solidly? It’s not on most people’s radar-and for good reason. Solidly V2 on Ethereum launched in 2022 with big promises: a new way to distribute fees, NFT-based staking, and a model that was supposed to fix what Curve Finance got wrong. Today, it’s barely hanging on.

What Solidly Actually Is (And Isn’t)

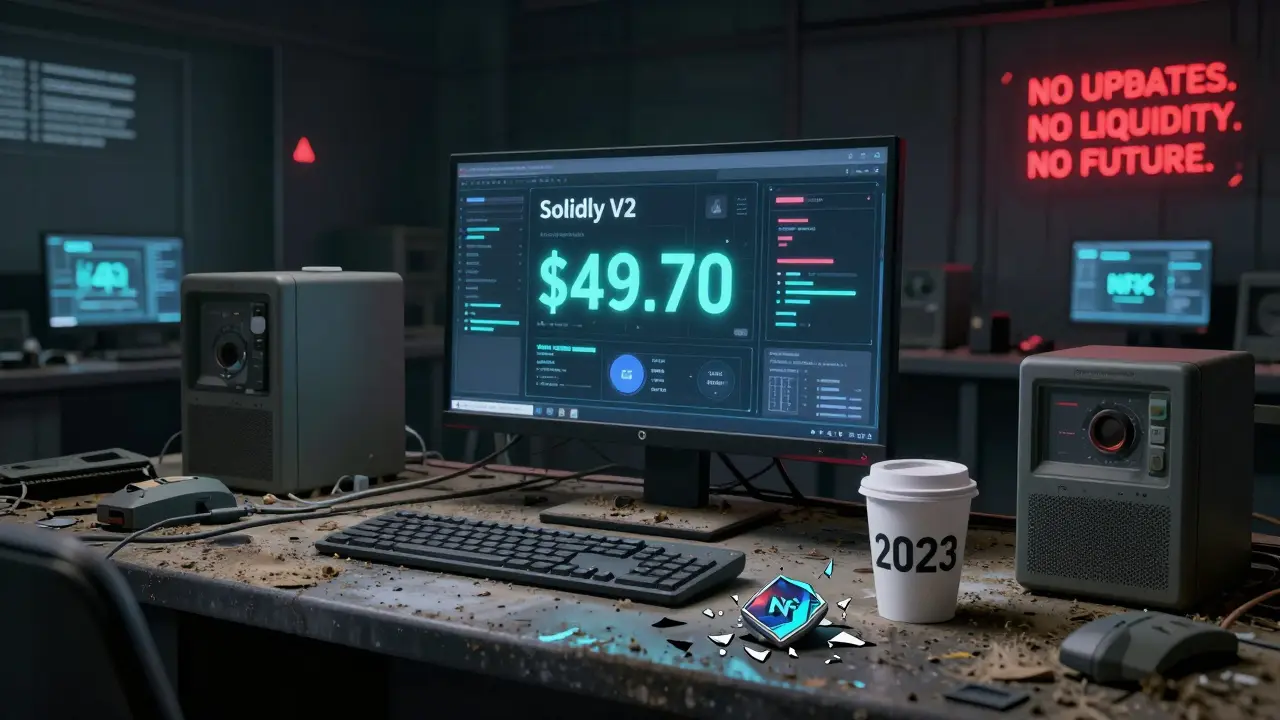

Solidly V2 is a decentralized exchange built on Ethereum. It uses an Automated Market Maker (AMM) model, just like Uniswap. But instead of letting everyone earn fees from every pool, Solidly forces you to pick just one pool to vote for. If you vote for LUSD/WETH, you only get fees from that pair. Nothing else. That’s the core idea. It sounds smart-why should you benefit from pools you didn’t support? But in practice, it’s created a dead end. You won’t find dozens of tokens here. Solidly only supports five coins: WETH, LUSD, DAI, USDC, and SOLID. That’s it. Five trading pairs total. The most active one? LUSD/WETH. And even that only traded $38.53 in the last 24 hours. The entire platform’s volume? $49.70. For context, Uniswap does that much in under five seconds.The SOLID Token: NFTs, Emissions, and a Broken Incentive

Solidly’s real innovation isn’t the trading interface-it’s the tokenomics. The native token, $SOLID, isn’t just a governance coin. When you stake it, you get an NFT. That NFT proves you’ve locked up SOLID. You can sell it. You can use it as collateral. That’s unusual. Most DeFi projects just give you a staking receipt you can’t trade. Solidly made it liquid. But here’s the catch: the more people stake SOLID, the fewer new tokens are issued. If everyone stakes everything, emissions drop to zero. That’s meant to create scarcity. But it’s also meant to punish early adopters. If you don’t stake, you get maximum emissions-but you also get no fee rewards, because you didn’t vote for any pool. If you do stake, you get fee rewards… but only from one pool. And that pool has almost no volume. It’s a feedback loop that doesn’t work. No volume → no fees → no reason to stake → lower emissions → no new incentive to join. The system is designed to collapse under its own weight. And it has.Why Nobody Uses It

Let’s talk numbers. Solidly has 4,163 monthly pageviews. That’s less than a small Reddit thread. Its Twitter has under 10,000 followers. Zero user reviews on FxVerify. No mentions in major DeFi analysis reports from 2025. Brave New Coin’s review of top exchanges didn’t even list Solidly. It’s not on Trustpilot. No one’s talking about it on Reddit. Why? Because it’s useless for trading. Try swapping $100 of DAI for WETH. You’ll get slippage over 5%. Maybe more. That’s not a bug-it’s the default. Liquidity is so thin that even tiny trades move the price. No active trader will touch this. No market maker will add capital here. No institutional fund will consider it. And there’s no safety net. No insurance fund. No bug bounty program. No documented roadmap. No team updates since 2023. The last GitHub commit? Over a year ago. The project is frozen.

How It Compares to Real DEXs

| Feature | Solidly V2 (Ethereum) | Uniswap V3 | Curve Finance |

|---|---|---|---|

| Trading Pairs | 5 | Over 1,000 | Over 200 |

| 24h Trading Volume | $49.70 | $1.2B+ | $450M+ |

| Liquidity Depth | Extremely low | High | Very high for stablecoins |

| Fee Distribution | Only for voted pool | Based on LP position | 50% of all fees to LPs |

| Staking Receipts | NFTs (tradable) | Standard tokens | Standard tokens |

| Margin Trading | No | No | No |

| User Reviews | 0 | Thousands | Thousands |

Who Is This For?

Honestly? No one. If you’re a trader, you’ll lose money. The slippage is too high. The volume is too low. The fees are meaningless. If you’re a liquidity provider, you’re putting capital into a dead pool. Even if you vote for LUSD/WETH, you’re earning pennies per week. The NFT receipt doesn’t help if no one wants to buy it. If you’re a DeFi researcher? Maybe. Solidly’s tokenomics are a fascinating case study in how good ideas can fail in real-world conditions. It’s like a lab experiment that never left the test tube. If you’re looking to earn yield? Go to Aave. Or Compound. Or even a stablecoin pool on Curve. They’re alive. Solidly is a ghost.

Roshmi Chatterjee

January 23, 2026 AT 03:51Okay but like… why is anyone still checking this? I stumbled on it by accident last week and my jaw dropped. $49 in 24 hours? That’s less than my coffee run. Solidly isn’t dead-it was never alive.

Paru Somashekar

January 23, 2026 AT 19:31While I appreciate the thorough analysis, I must respectfully disagree with the assertion that Solidly is entirely without merit. The NFT-based staking mechanism, though underutilized, represents a novel approach to liquidity incentive design. One might argue that its failure is less about the concept and more about timing and community engagement.

Steve Fennell

January 24, 2026 AT 14:21Wow. This is exactly why I left DeFi last year. 😔 I saw this thing pop up in my feed, thought 'maybe this is the one', checked the volume… and just closed the tab. No offense to the devs, but if your DEX has less traffic than a Medium post, it’s not a protocol-it’s a museum piece.

Heather Crane

January 26, 2026 AT 03:05OMG YES!!! This is so true!!! I literally tried to swap 10 DAI for WETH and got a 7% slippage!!! Like… what??? Who designed this??? It’s not even a joke-it’s a tragedy!!! 🥲

Nathan Drake

January 27, 2026 AT 12:55It’s funny how we treat crypto projects like they’re supposed to last forever. Maybe Solidly wasn’t meant to be a platform-it was meant to be a lesson. A quiet, elegant demonstration of how incentive structures can collapse when human behavior doesn’t align with the math.

Melissa Contreras López

January 29, 2026 AT 03:12Y’all are being too nice. Solidly isn’t just dead-it’s a haunted house where the ghosts are still trying to pay rent. That NFT staking? Cute. But if no one’s trading, your NFT’s just a digital post-it note with ‘I believed’ written on it. Move on. There’s real yield out there.

Taylor Mills

January 30, 2026 AT 18:35lmao imagine thinking this shit was ever gonna work. u think ur smart for staking SOLID? u just got scammed by a 2022 meme. go trade on binance like a normal person. also why is everyone still talking about this? it’s like arguing about a broken toaster from 2018.

HARSHA NAVALKAR

January 30, 2026 AT 22:28i just… i don’t get it. i read this whole thing. i checked the contract. i saw the volume. i’m not mad. i’m just… empty. like i wasted 10 minutes of my life on something that never existed. maybe i’m the problem.

Ryan Depew

January 31, 2026 AT 14:02bro this is why i don’t touch anything that isn’t on arbitrum or base. ethereum fees alone should’ve killed this. and now it’s just a ghost town with a fancy NFT sticker on the door. i’d rather rug pull my own wallet than stake here.

Kevin Pivko

February 1, 2026 AT 03:37They didn’t fail. The market failed them. Solidly was too ahead of its time. Everyone’s too lazy to understand tokenomics anymore. You want liquidity? Build it. You want volume? Attract it. Instead, people just scream 'dead project' and scroll. The real failure is us.

Mathew Finch

February 2, 2026 AT 17:33Uniswap is for peasants. Curve is for stablecoin plebs. Solidly was the only real DeFi project that dared to challenge the status quo. The fact that it died proves the system is rigged. The masses don’t want innovation-they want convenience. And that’s why crypto will never be decentralized.

Jessica Boling

February 4, 2026 AT 12:22so you're telling me this thing has less volume than my cat's instagram account? wow. congrats solidly. you've achieved peak obscurity. i'm gonna frame this review and hang it in my bathroom as a reminder to never trust anything that sounds like a thesis

Tammy Goodwin

February 6, 2026 AT 07:48I think the real tragedy here isn’t that Solidly failed-it’s that so few people even noticed it was gone. We’re so obsessed with the next big thing that we forget to mourn the ones that tried. Rest in peace, Solidly. You had a good idea.

Andy Simms

February 6, 2026 AT 20:34For anyone still considering staking SOLID: check the contract address. Look at the last 50 transactions. You’ll see 47 are from the dev wallet doing internal transfers. The other 3? People trying to withdraw their last 0.001 ETH. Walk away. Seriously.