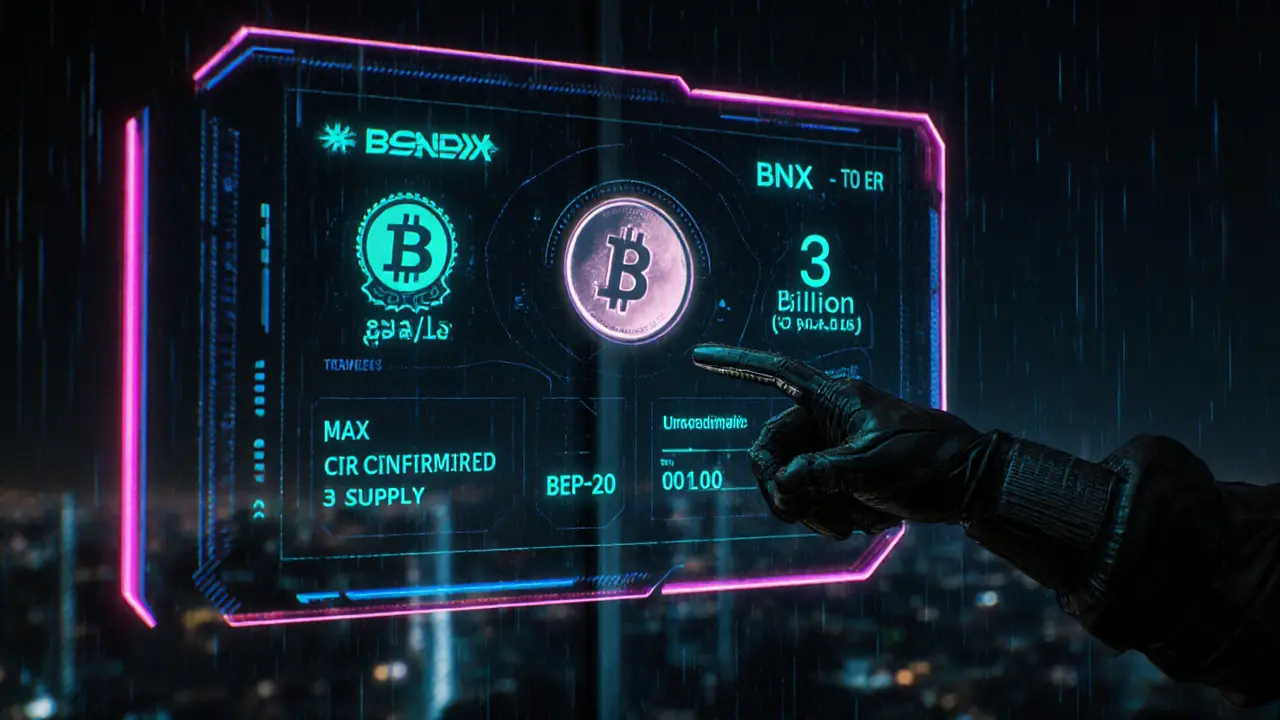

Learn what BONDX (BNX) is, its tokenomics, market data, risks, and how to trade it on Binance Smart Chain. A concise guide for crypto newbies.

Read MoreBEP-20 Token Standard: What It Is and Why It Matters

When working with BEP-20, a token standard on the Binance Smart Chain that defines how fungible tokens behave and interact. Also known as BSC BEP‑20, it enables developers to create tokens that can be swapped, staked or used in DeFi apps. Binance Smart Chain, a high‑performance blockchain that supports smart contracts and low‑fee transactions provides the underlying network, while ERC-20, Ethereum’s original token standard serves as a design reference. In short, BEP-20 encompasses token creation on BSC, requires Solidity‑based smart contracts, and inherits many concepts from ERC‑20. This connection means that tools built for ERC‑20 often work with BEP‑20 with minimal tweaks, and DeFi platforms can accept both standards.

How BEP-20 Powers Real‑World Crypto Use Cases

Developers choose BEP‑20 because the Binance Smart Chain offers faster block times and cheaper gas than Ethereum, which translates into lower costs for users swapping tokens on DEXes or providing liquidity. DeFi applications, protocols for lending, borrowing, staking and yield farming rely heavily on BEP‑20 tokens to represent assets, reward users, and manage governance. Crypto exchanges list BEP‑20 assets alongside ERC‑20 and native BNB tokens, giving traders more options. The tokenomics of a BEP‑20 project—total supply, decimals, burning mechanisms—are defined in the smart contract, so investors can verify the rules before committing capital. Because the standard is open‑source, security audits can focus on known patterns, reducing the chance of hidden bugs. In practice, a BEP‑20 token can be minted, burned, or transferred with a single function call, making integration into wallets and payment processors straightforward.

The process of launching a BEP‑20 token starts with writing a Solidity contract that follows the standard’s required functions: totalSupply, balanceOf, transfer, approve and transferFrom. After testing on the BSC testnet, developers deploy to the mainnet, where the token immediately becomes usable in any BSC‑compatible wallet or DEX. Ongoing maintenance might involve upgrading the contract via a proxy pattern or adding features like pausable transfers. Looking ahead, the BEP‑20 ecosystem is expanding with cross‑chain bridges, allowing tokens to move between BSC, Ethereum and other networks, which further blurs the line between ERC‑20 and BEP‑20. Below you’ll find a curated set of articles that dive deeper into BEP‑20 security, fee structures on popular exchanges, token‑omics breakdowns, and step‑by‑step guides for creating and testing your own BEP‑20 asset. These resources will give you the practical insights you need to navigate the BEP‑20 landscape with confidence.

node.sys (NYS) Crypto Coin Explained - What It Is, How It Works, and Risks

Discover what node.sys (NYS) crypto coin is, its tech, market data, how to use it, and the risks involved-all in plain language.

Read More