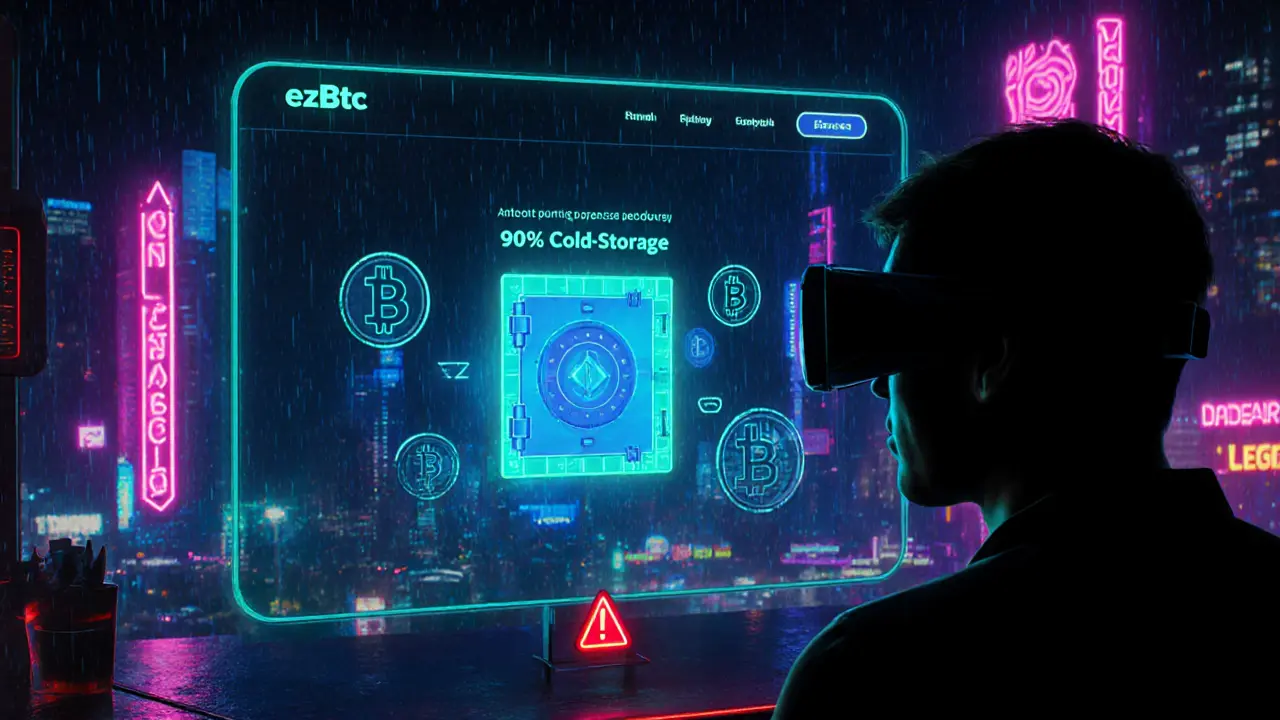

An in‑depth ezBtc review covering its promised features, fee structure, the $13M fraud uncovered by the BCSC, comparison with legit exchanges, and tips to avoid similar scams.

Read MoreBitcoin theft – what you need to know

When dealing with Bitcoin theft, the illegal taking of Bitcoin through hacks, scams, or fraud. Also known as crypto robbery, it often starts with a breach of a cryptocurrency exchange, an online platform where users buy, sell, and store digital assets or a lapse in blockchain security, the cryptographic and network measures that protect transaction integrity. Strong crypto regulation can tighten the rules around these platforms, but weak or unclear policies often give thieves a foothold. In short, Bitcoin theft encompasses unauthorized transfers, requires vulnerable exchange security, and is influenced by the regulatory environment.

Common vectors that lead to Bitcoin theft

Phishing emails that mimic exchange login pages are one of the cheapest ways for criminals to steal credentials. Once they have access, they move funds to cold wallets that sit outside the exchange’s security perimeter. Insider abuse is another hidden risk: employees with privileged keys can siphon off assets before anyone notices. Malware on a trader’s computer can also capture seed phrases, letting thieves recreate wallets offline. Each of these methods exploits a gap in either exchange practices or blockchain safeguards. For example, a platform that stores most funds in hot wallets without multi‑signature protection creates an attractive target, while a blockchain that lacks robust consensus monitoring makes double‑spend attacks easier.

Regulators worldwide are trying to tip the balance. In Canada, the New Brunswick mining moratorium mentioned in our collection shows how policy can limit the energy cheap enough for large‑scale attacks, indirectly reducing the incentive for certain thefts. Meanwhile, stricter KYC/AML rules force exchanges to verify users more thoroughly, shrinking the pool of anonymous attackers. Yet, over‑regulation can push users toward unregulated, riskier platforms, which often lack the security infrastructure needed to fend off theft. The sweet spot is a clear legal framework that encourages exchanges to adopt best‑in‑class security measures—cold storage, hardware‑based authentication, and regular third‑party audits—while keeping users protected.

Below you’ll find a curated set of articles that dive deeper into exchange reviews, security breach case studies, regulatory updates, and practical steps you can take to shield your Bitcoin from theft. Use them to build a solid defense strategy and stay ahead of the next big hack.