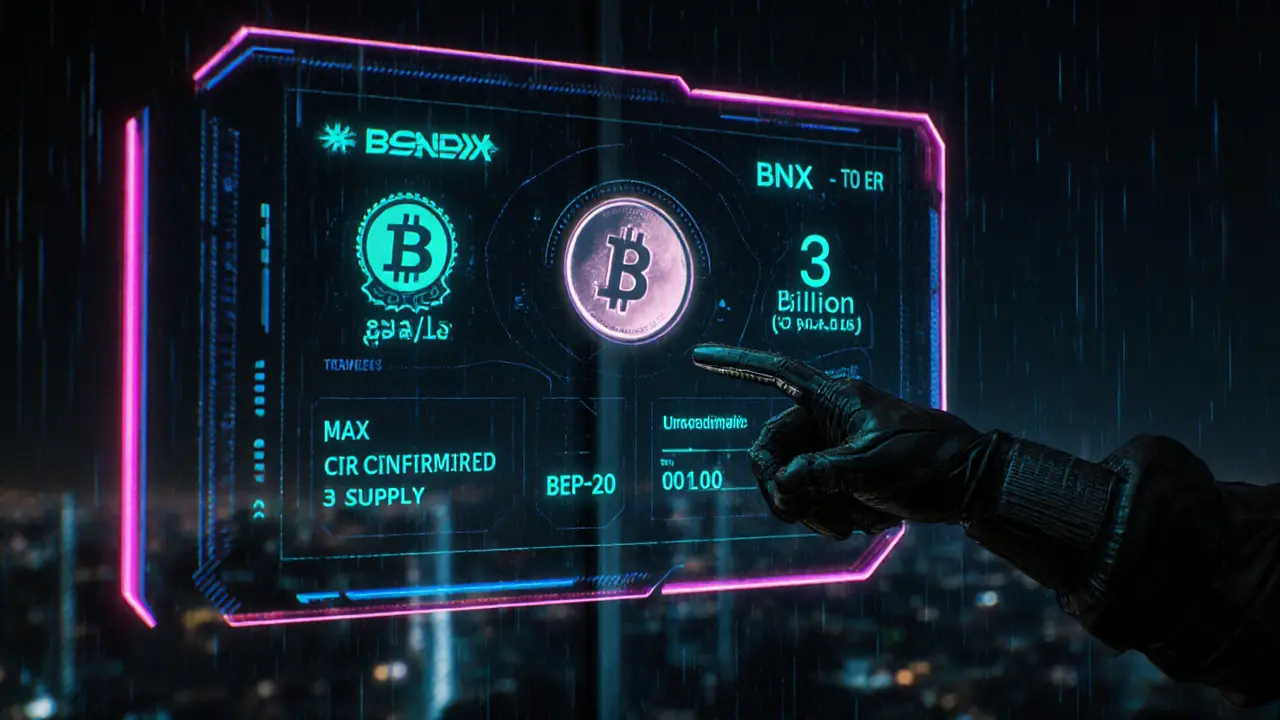

Learn what BONDX (BNX) is, its tokenomics, market data, risks, and how to trade it on Binance Smart Chain. A concise guide for crypto newbies.

Read MoreBONDX: Your Gateway to Tokenized Bonds and Fixed‑Income Crypto

When exploring BONDX, the tokenized bond index that tracks a diversified basket of global corporate and government bonds on the blockchain. Also known as Bond Index Token, it gives crypto users a simple way to tap into the fixed‑income market without a traditional broker. Bond ETFs and tokenized bonds are the core building blocks that make a token like BONDX possible, while fixed income strategies provide the stability many traders look for.

Why BONDX matters for crypto investors

BONDX encompasses a basket of over 200 high‑grade bonds, so the token inherits the low‑volatility profile of traditional fixed‑income assets. That means you get exposure to interest‑rate yields without the hassle of buying each bond individually. Tokenized bonds enable blockchain‑based settlement, which reduces paperwork and speeds up transfers. In practice, this translates to faster on‑chain trades, lower custody costs, and the ability to integrate bond exposure into DeFi protocols. If you already use decentralized exchanges, you can swap BONDX just like any other ERC‑20 token.

Another key relationship is that BONDX requires reliable price oracles to reflect real‑time bond market movements. Accurate oracles ensure the token’s net asset value stays in line with its underlying bonds, preventing arbitrage gaps. This link between oracles and tokenized bonds is crucial for maintaining trust in the ecosystem. Likewise, fixed‑income strategies often rely on yield‑curve analysis, an approach that helps investors decide when to add or reduce exposure to BONDX.

Many users wonder how BONDX differs from traditional bond ETFs. The main distinction is custody: with BONDX, your position lives in a non‑custodial wallet, giving you full control over private keys. That also opens the door for composability—developers can program smart contracts that automatically rebalance BONDX holdings based on market signals. In short, BONDX combines the safety of bonds with the flexibility of crypto.

If you’re new to the concept, think of BONDX as a digital mutual fund that you can hold in a hardware wallet. Its attributes include: diversified bond exposure (corporate, sovereign, emerging‑market), daily NAV updates via oracles, and compatibility with DeFi lending platforms. The token’s value is anchored to the underlying bond pool, which historically shows lower drawdowns than pure crypto assets. For risk‑averse traders, adding BONDX to a portfolio often improves the Sharpe ratio without sacrificing upside potential.

Security is another piece of the puzzle. Because BONDX operates on a public blockchain, transaction transparency is built‑in. However, smart‑contract bugs can still pose risks. That’s why reputable projects audit their contracts and use multi‑sig governance for parameter changes. When assessing any tokenized bond, always check for third‑party audits and community governance records.

From a regulatory perspective, tokenized bonds sit in a gray area in many jurisdictions. Some authorities treat them as securities, while others view them as utility tokens. This ambiguity means investors should stay informed about local rules before moving large sums. Projects that partner with licensed custodians often enjoy clearer compliance pathways, which can boost user confidence.

Putting it all together, BONDX sits at the intersection of three major entities: bond ETFs that provide the underlying asset mix, tokenized bonds that bring those assets onto the blockchain, and fixed‑income strategies that shape how investors use the token. Understanding each piece helps you decide whether BONDX fits your risk profile and investment goals.

Below you’ll find a curated collection of articles that dive deeper into exchange reviews, tokenomics, regulatory updates, and practical how‑to guides—all relevant to anyone interested in BONDX and the broader world of crypto‑linked bonds. Explore the pieces to see real‑world examples, step‑by‑step setups, and expert insights that can sharpen your approach.