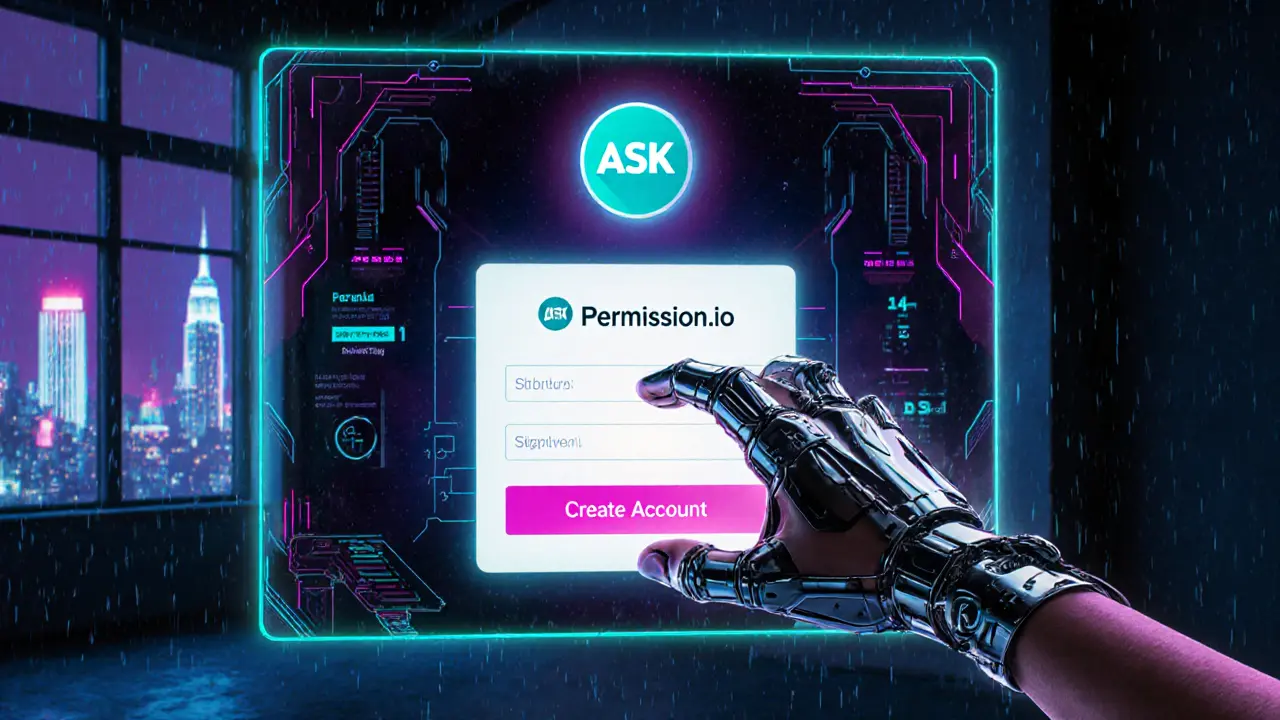

Discover everything about the ASK token airdrop by Permission.io: how to claim, reward tiers, token economics, market data and future outlook-all in one guide.

Read MoreCryptocurrency Airdrop: How to Claim, Spot Risks, and Stay Updated

When working with cryptocurrency airdrop, a free token distribution event that projects use to promote new coins or reward community members. Also known as airdrop, it helps bootstrap network effects and gather user data. In plain terms, an airdrop is a way for developers to sprinkle tokens into many wallets so users can try the product without spending a dime. The concept grew with early Bitcoin giveaways and exploded when DeFi projects needed quick exposure. Think of it as a free sample in a grocery store – you get a bite, decide if you like the flavor, and maybe come back for more. This page pulls together everything you need to know before you click that ‘claim’ button.

Key Elements Behind a Successful Airdrop

The engine that powers an airdrop is token distribution, the systematic allocation of crypto assets to eligible addresses. It often relies on smart contracts that automatically verify criteria like holding a certain token, completing a KYC step, or joining a community channel. Because token distribution runs on a blockchain, an immutable ledger that records every transaction, the process is transparent but also vulnerable to clever scams. A solid airdrop needs three things: a clear eligibility rule, a secure distribution method, and a real utility for the token afterward. For instance, the WSPP airdrop on Polygon combined a low‑fee network with a solid audit, while the KingMoney WKIM Mjolnir drop faltered because the project lacked a trustworthy smart contract. Understanding how cryptocurrency airdrop ecosystems fit together lets you separate genuine opportunities from hype‑driven bait.

Now that you see the moving parts, the next step is to evaluate each drop on its own merits. Look for a reputable project team, a published whitepaper, and an audit report—these are the safety nets that protect your wallet. Check the token’s purpose: does it grant governance rights, enable staking, or serve as a utility within a platform? If the answer is vague, it’s a red flag. Also, verify the claim process: legitimate airdrops never ask for private keys, and most require only a wallet address and maybe a social proof tweet. By matching the eligibility checklist with the underlying blockchain’s security, you can gauge the risk level before you invest any time. The posts below walk you through specific airdrops, from the Polygon‑based WSPP to the RingDAO RING token, and give you step‑by‑step claim guides, risk assessments, and market data.

Ready to dive deeper? Below you’ll find detailed articles that break down the latest airdrop opportunities, explain how to back‑test the token’s performance, and show you how to avoid common pitfalls. Whether you’re a beginner looking for a free entry point or an experienced trader hunting high‑value drops, the collection offers practical insights you can act on right now.