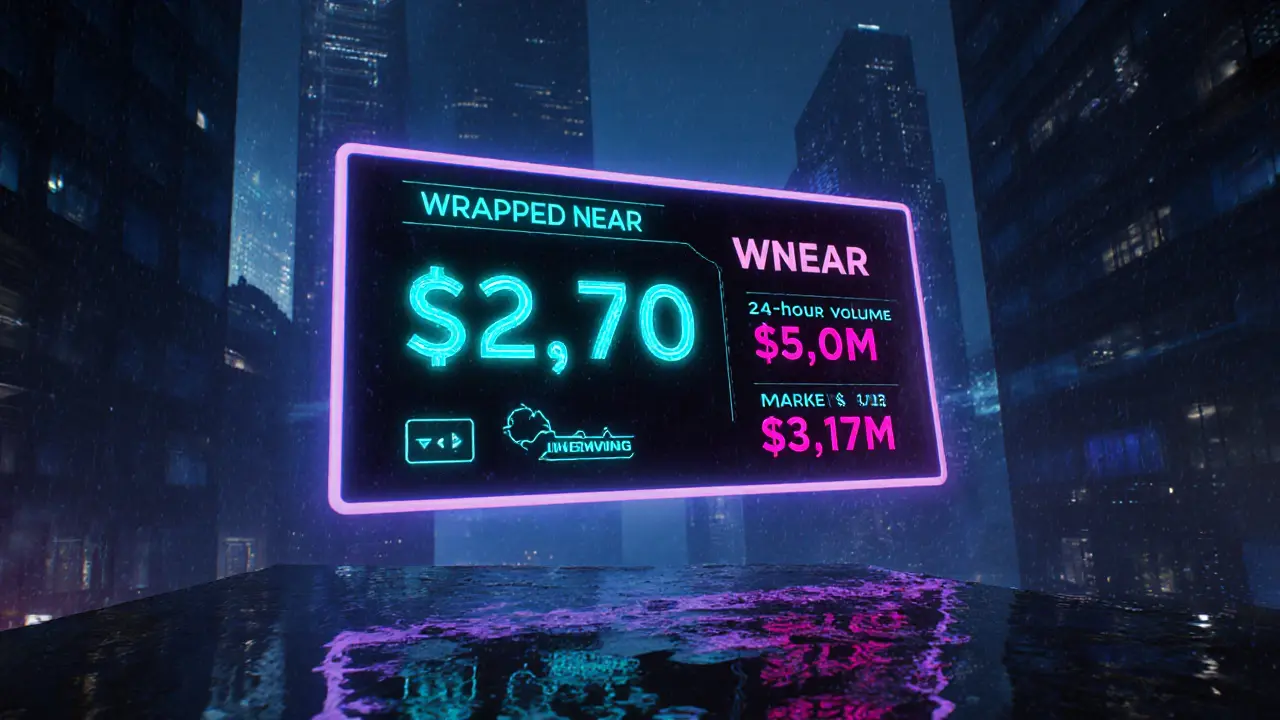

Wrapped Near (WNEAR) Price Tracker

Current Price

24-Hour Trading Volume

Market Cap

Weekly Performance

About WNEAR

Wrapped Near (WNEAR) is a 1:1 tokenized version of NEAR Protocol’s native coin, enabling cross-chain liquidity and DeFi access. As of August 2025, WNEAR trades around $2.70 with a market cap of about $3.2M.

Key Metrics:

- Peg Ratio: 1 WNEAR = 1 NEAR

- Circulating Supply: 1,157,133 WNEAR

- Primary Purpose: Cross-chain DeFi and liquidity provisioning

Trading Venues

Major trading venues include Rhea Finance, Trisolaris, Wannaswap and AuroraSwap. Liquidity is fragmented across these platforms.

- Rhea Finance - Highest reported volume

- Trisolaris - NEAR-focused DEX

- Wannaswap - Lower fees

- AuroraSwap - Bridges to Aurora EVM

Quick Takeaways

- Wrapped Near (WNEAR) is a 1:1 tokenized version of NEAR Protocol’s native coin.

- It enables NEAR assets to move across blockchains and be used on many DEXs.

- As of August2025, WNEAR trades around $2.70 with a market cap of about $3.2M.

- Major trading venues include Rhea Finance, Trisolaris, Wannaswap and AuroraSwap.

- Key risks are price volatility, limited exchange listings and reliance on NEAR’s roadmap.

When talking about cross‑chain finance, Wrapped Near (WNEAR) is a tokenized representation of the native NEAR token that maintains a 1:1 peg while allowing the asset to operate on other blockchain networks. The wrapped format turns NEAR into a bridge asset, opening doors to DeFi protocols that otherwise don’t support the original coin.

What Exactly Is Wrapped Near?

At its core, WNEAR follows the same model as other wrapped assets: a smart contract locks up an equal amount of the native token on the source chain, then issues a corresponding amount on the destination chain. The process is reversible - users can “unwrap” WNEAR at any time to retrieve the original NEAR.

Key attributes of WNEAR:

- Peg ratio: 1WNEAR = 1NEAR

- Supply: 1,157,133WNEAR circulating (no hard cap)

- Primary purpose: cross‑chain liquidity and DeFi access

Why Use WNEAR Instead of Native NEAR?

The main driver is interoperability. Native NEAR can only run on the NEAR blockchain, so it can’t directly interact with Ethereum‑based AMMs, lending platforms, or other ecosystems. By wrapping NEAR, holders can:

- Provide liquidity on Ethereum‑compatible DEXs.

- Participate in yield‑farms that require ERC‑20 tokens.

- Swap quickly without moving funds through centralized exchanges.

In practice, this means a NEAR holder can earn extra yields on platforms like Rhea Finance while still retaining the ability to revert to the original NEAR whenever they need it.

Current Market Snapshot (August2025)

WNEAR’s price reached an all‑time high of $20.46 back in early 2023. Today the token sits near $2.70, reflecting an 86.6% correction. Despite the drop, the token has shown resilience:

- 24‑hour trading volume: ≈$25.8M

- Weekly performance (28Aug2025): +17% versus the broader market’s +11%

- Market cap: ≈$3.17M

How to Acquire and Store WNEAR

The token isn’t listed on most major centralized exchanges. The most straightforward path is through a web3 wallet that connects to a DEX supporting WNEAR. Popular options include:

- Binance Web3 Wallet - native integration with several NEAR‑compatible DEXs.

- MetaMask (configured for the Aurora network) - lets you add WNEAR as a custom token.

Once you have WNEAR, you can store it in any ERC‑20‑compatible wallet: hardware wallets (Ledger, Trezor), mobile wallets (Trust Wallet), or desktop clients (Near Wallet). For custodial users, several exchanges offer “wrapped” balances that can be unwrapped on‑chain when needed.

Where to Trade WNEAR

Liquidity is fragmented across a handful of decentralized platforms. The most active pairs involve WNEAR/0XC and WNEAR/ETH. Below is a quick rundown of the top venues:

- Rhea Finance - highest reported volume, especially the WNEAR/0XC pair (≈$7,200).

- Trisolaris - NEAR‑focused DEX with robust swap routes.

- Wannaswap - lower fees, good for small‑scale traders.

- AuroraSwap - bridges to the Aurora EVM, enabling easy interaction with Ethereum tools.

- NearPAD - emerging platform with a focus on NFT marketplaces that accept WNEAR.

Note that KuCoin does not list WNEAR directly; the exchange advises users to move funds to a supported DEX for wrapping/unwrapping.

Wrapped Near vs. Native NEAR vs. Other Wrapped Tokens

| Token | Chain Compatibility | Primary Use Case |

|---|---|---|

| WNEAR | ERC‑20 (Aurora/Ethereum) + NEAR‑native | Cross‑chain DeFi, liquidity provisioning |

| NEAR | NEAR Protocol only | Staking, native dApp interactions |

| Wrapped Bitcoin (WBTC) | ERC‑20 (Ethereum) | Bitcoin liquidity on Ethereum DeFi |

| Wrapped Ether (WETH) | ERC‑20 (Ethereum) | Standardized Ether handling in smart contracts |

Compared with native NEAR, WNEAR sacrifices direct protocol features (like staking) for broader market access. When stacked against WBTC or WETH, WNEAR is newer and less liquid, but it offers a gateway to the fast, low‑fee NEAR ecosystem.

Risks and Considerations

Investing in WNEAR comes with a handful of caveats:

- Volatility: The token has fallen more than 80% from its peak.

- Liquidity Concentration: Over 80% of volume sits on a single pair (WNEAR/0XC), making large trades price‑impact heavy.

- Dependency on NEAR: If the NEAR protocol stalls, WNEAR loses its core value proposition.

- Smart‑contract risk: Wrapped tokens rely on the wrapping contract staying secure and properly audited.

Always keep a portion of your holdings in the native token if you plan to stake or use NEAR‑specific dApps; this mitigates the risk of being locked into a wrapped form.

Future Outlook for WNEAR

The next wave of growth hinges on three factors:

- NEAR ecosystem expansion: New DeFi projects, gaming dApps, and enterprise partnerships increase demand for cross‑chain liquidity.

- Bridge improvements: Upgrades to the Aurora bridge and potential integrations with Polygon or Binance Smart Chain could broaden WNEAR’s reach.

- Listing pushes: If major DEX aggregators add WNEAR to their routing tables, the token may see a surge in volume and tighter spreads.

Watch for announcements from the NEAR Foundation and from the development teams behind Rhea Finance and Trisolaris - they often signal when new bridge features go live.

Frequently Asked Questions

What does it mean that WNEAR is a 1:1 peg?

For every WNEAR token in circulation, an equivalent amount of native NEAR is locked in a smart contract. You can always redeem 1WNEAR for 1NEAR, so the market price stays roughly aligned with the underlying asset.

Can I stake WNEAR on the NEAR network?

Staking requires the native NEAR token. WNEAR is designed for cross‑chain use, so you’d need to unwrap it first before you can stake.

Which wallet is safest for storing WNEAR?

Hardware wallets such as Ledger or Trezor that support the Aurora/EVM network provide the highest security. If you prefer software, the official Near Wallet or MetaMask (configured for Aurora) are solid choices.

Where can I swap WNEAR for other tokens?

The most liquid swaps happen on Rhea Finance, Trisolaris, Wannaswap and AuroraSwap. Connect your web3 wallet, select the WNEAR pair you need, and approve the transaction.

Is WNEAR a good long‑term investment?

It depends on your view of the NEAR ecosystem. If you believe NEAR will keep growing and need cross‑chain liquidity, WNEAR could appreciate. However, its price is tightly linked to NEAR’s success and to overall DeFi demand, so treat it as a speculative asset.

Rajini N

April 1, 2025 AT 05:06WNEAR gives NEAR holders a gateway to Ethereum‑based DeFi without giving up their underlying asset. The 1:1 peg means you can always swap back, which reduces risk compared to unbacked tokens. Just remember to keep some NEAR handy for staking if you plan to unwrap later. Overall it’s a useful tool for liquidity hopping.

Jason Brittin

April 1, 2025 AT 05:08Wow, another wrapped token to juggle – because we clearly needed more complexity in our portfolios 😂🚀.

Michael Wilkinson

April 1, 2025 AT 05:10Stop hyping this dead coin.

Billy Krzemien

April 1, 2025 AT 05:13For anyone new to the space, the key is to understand that WNEAR isn’t a magic profit machine; it’s a bridge. Use reputable DEXs like Rhea Finance and keep your private keys safe. If you unwrap, you regain full NEAR functionality, so there’s no real downside beyond gas fees.

Clint Barnett

April 1, 2025 AT 05:18Wrapped Near (WNEAR) operates on the same fundamental principle as other wrapped assets, locking native NEAR in a smart contract and issuing an ERC‑20 representation on Aurora or Ethereum. This design enables cross‑chain arbitrage opportunities that were previously unavailable to NEAR‑only users. Because the peg is maintained algorithmically, any deviation from the 1:1 ratio should self‑correct through market forces. Liquidity, however, remains fragmented across Rhea Finance, Trisolaris, Wannaswap, and AuroraSwap, which can lead to noticeable slippage on larger trades. Traders often route through the WNEAR/0XC pair on Rhea Finance due to its higher volume, but the concentration risk is real. The weekly increase of +17% suggests renewed interest, yet the token is still only a small‑cap with a market cap of about $3.2 million. One should also be aware that gas costs on Ethereum can erode returns unless the transaction is sizable. Staking, on the other hand, is only possible with the native NEAR token, so holding WNEAR alone limits participation in that ecosystem. For risk‑averse investors, keeping a portion of holdings in native NEAR serves as a hedge against contract vulnerabilities. The bridge contracts have undergone audits, but no system is completely immune to exploits. Community sentiment is cautiously optimistic, especially with upcoming bridge upgrades slated for Q4 2025. If the NEAR Foundation continues to expand its DeFi partnerships, demand for WNEAR could rise appreciably. Conversely, any slowdown in NEAR’s roadmap may suppress WNEAR’s utility and price. It’s also worth noting that many centralized exchanges still do not list WNEAR, funneling most activity to DEXs. Finally, always verify token contract addresses before adding WNEAR to a wallet to avoid malicious clones.

Kate Nicholls

April 1, 2025 AT 05:25The article glosses over the fact that WNEAR’s liquidity is dangerously thin; a single whale can move the market.

Oreoluwa Towoju

April 1, 2025 AT 05:31Do you think the bridge security has been fully vetted?

MD Razu

April 1, 2025 AT 05:38Liquidity concentration is indeed a symptom of a deeper market inefficiency; when the majority of trades funnel through a single pair, price discovery becomes distorted, mirroring the echo chambers of modern finance. The philosophical implication is that value, in this context, is not intrinsic but socially constructed, dependent on the trust we collectively place in smart contracts and the platforms that host them. If trust erodes, the peg could break, leading to a cascade of arbitrage opportunities that may not benefit the average holder. Hence, the risk isn’t merely technical-it’s epistemological, rooted in our collective belief in decentralised systems.

Charles Banks Jr.

April 1, 2025 AT 05:45Ah, so we’re now pondering the metaphysics of token liquidity? Next you’ll tell us the blockchain is a simulation. 🙄

Ben Dwyer

April 1, 2025 AT 05:53Keeping a balanced portfolio between native NEAR and WNEAR is a pragmatic approach for most users.

Naomi Snelling

April 1, 2025 AT 06:03What most people don’t realize is that the DeFi ecosystem is a playground for hidden actors who manipulate token supplies behind the scenes. Wrapped assets like WNEAR are especially vulnerable because they rely on bridge contracts that could be backdoored, allowing a select few to siphon off funds under the guise of “liquidity provision”. These entities often operate through opaque DAO structures, making accountability virtually impossible. The market data we see-volumes, price spikes-could be fabricated to lure unsuspecting investors into a trap. It’s wise to stay skeptical and verify every contract’s source code before committing capital.

Jacob Anderson

April 1, 2025 AT 06:13Sure, because every wrapped token magically solves all problems.

Carl Robertson

April 1, 2025 AT 06:25The hype train for WNEAR is nothing but a mirage, a fleeting spark that will soon burn out, leaving only the ashes of disappointed traders.

Kate Roberge

April 1, 2025 AT 06:36Actually, I’d argue that the current price dip is a perfect entry point for contrarians looking to capitalize on the inevitable rebound.

Amie Wilensky

April 1, 2025 AT 06:50WNEAR, as a wrapped asset, offers interoperability; however, its success hinges on bridge stability, market adoption, and regulatory clarity; these factors, combined with the inherent volatility of crypto, create a complex risk profile; investors must therefore conduct rigorous due diligence, assess their risk tolerance, and consider diversification; otherwise, they may find themselves exposed to unforeseen challenges.

Katrinka Scribner

April 1, 2025 AT 07:03Love how WNEAR opens up new DeFi doors for NEAR fans! 🌟🚀

VICKIE MALBRUE

April 1, 2025 AT 07:16Great potential ahead

Waynne Kilian

April 1, 2025 AT 07:31I think the future of cross‑chain assets like WNEAR is bright, as long as the community stays vigilant and continously improves security.

april harper

April 1, 2025 AT 07:46The shadows whisper that WNEAR’s destiny is entwined with the rise and fall of unseen forces, a drama playing out on the digital stage.

Lindsay Miller

April 1, 2025 AT 08:03It’s okay to feel unsure; take your time to learn and ask questions, the community is here to help.