Explore the current status of the FLTY (Fluity) airdrop on CoinMarketCap, learn how to verify legitimacy, and get ready for any future distribution with practical steps and safety tips.

Read MoreApril 2025 Archive – Your Guide to Paper Trading, Crypto Demos, and Stock Simulation

When browsing the April 2025 archive, a curated collection of posts published in April 2025 on Buy Fake Money. Also known as April 2025 posts, it offers a snapshot of the latest tools and strategies for virtual investing.

One of the core pillars covered in this period is paper trading, trading with virtual funds that mimics real market conditions without risking capital. Paper trading lets beginners test ideas while seasoned traders fine‑tune edge cases. The archive also dives into crypto demo accounts, testnet environments where users can practice buying, selling, and holding tokens with mock balances. These demo accounts require knowledge of testnet token faucets and blockchain explorers, linking the concept of virtual funds directly to blockchain fundamentals. Moreover, the collection highlights the stock market simulator, a web‑based platform that mirrors real‑time equity data and lets you build demo portfolios. The simulator’s real‑time feed influences how users set stop‑losses and target prices, showing a clear cause‑effect relationship between market data and simulated trades.

Beyond the tools, the April 2025 archive delves into backtesting, the process of applying historical market data to a trading strategy to gauge its potential performance. Backtesting requires a solid data set and a systematic approach, and the posts explain how to import CSV price histories into the simulator, run a moving‑average crossover, and interpret results. Together, these pieces illustrate three semantic triples: paper trading encompasses virtual funds, crypto demo accounts require testnet tokens, and backtesting influences strategy refinement. Readers will also find quick guides on linking a demo wallet to the simulator, interpreting real‑time charts, and adjusting risk parameters based on backtest outcomes.

What You’ll Find in This Collection

Below, the archive lists each article with a brief takeaway—whether it’s a step‑by‑step setup for a new crypto testnet, a cheat sheet for common paper‑trading pitfalls, or a deep dive into creating a balanced demo stock portfolio. Use the summaries to jump straight to the content that matches your skill level, then apply the practical tips in your own virtual trading playground.

Gravity Finance (GFI) Crypto Coin Explained - What It Is, How It Works, and Risks

Learn what Gravity Finance (GFI) crypto coin is, how its Bitcoin‑backed fee model works, tokenomics, market performance, risks, and how to trade it on Polygon.

Read MoreUniswap v4 on Avalanche: In‑Depth Crypto Exchange Review

In-depth review of Uniswap v4 on Avalanche covering fees, speed, hooks, liquidity, user experience, and comparison with other exchanges.

Read MoreFooDriver (FDC) Crypto Coin Explained - Definition, Tokenomics & How It Works

Discover FooDriver (FDC) crypto coin: definition, tokenomics, utility, roadmap and how it reshapes food delivery with blockchain.

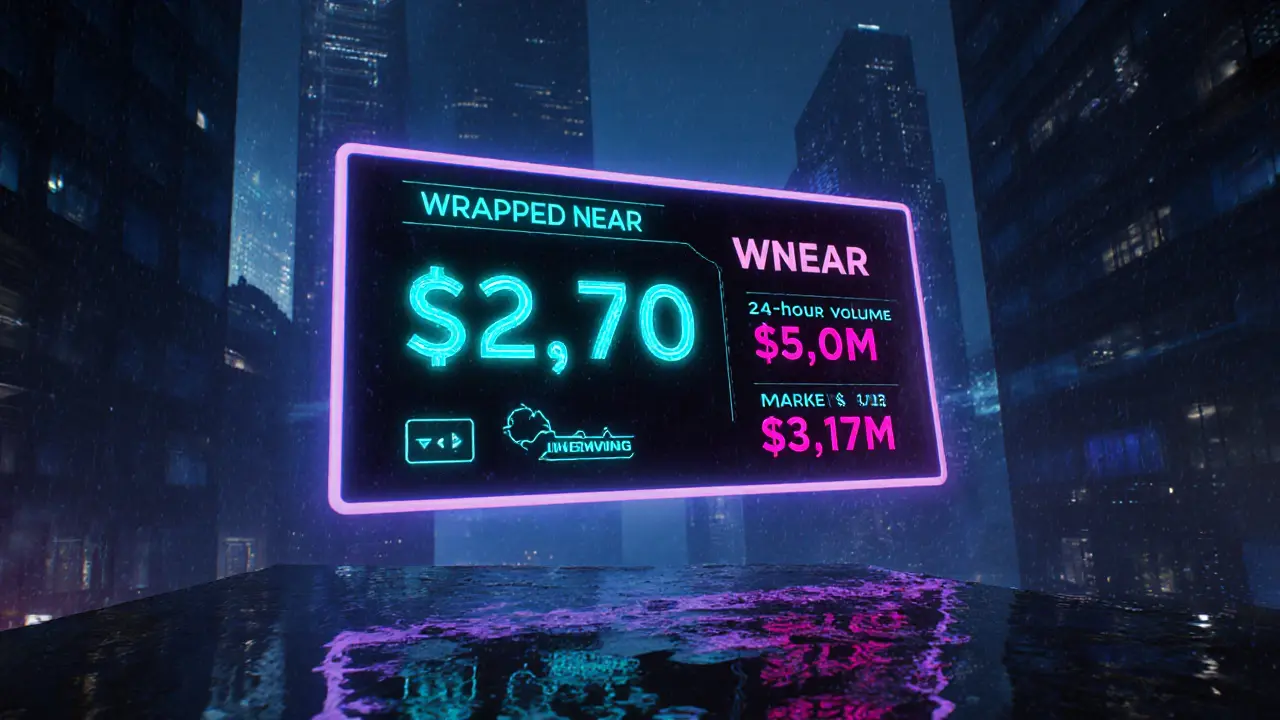

Read MoreWrapped Near (WNEAR) Explained: What It Is, How It Works, and Where to Trade

Learn what Wrapped Near (WNEAR) is, how it enables cross‑chain DeFi, where to trade it, and the risks and opportunities for investors.

Read More