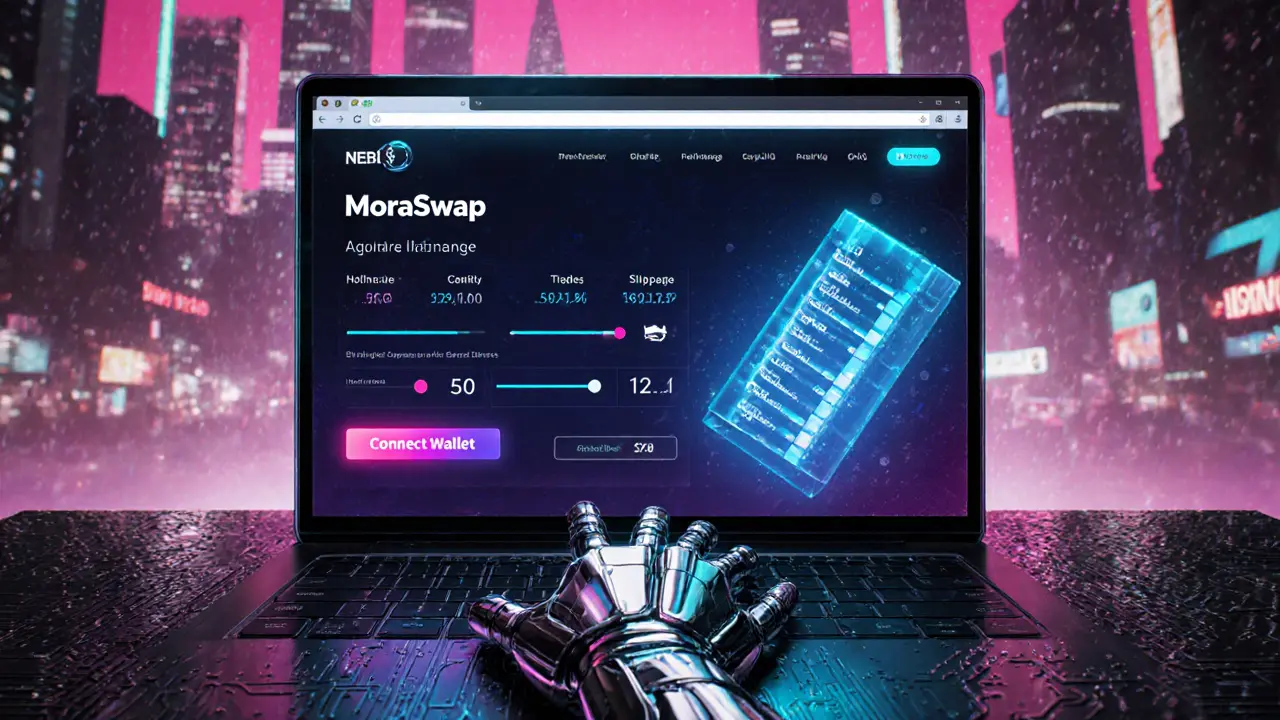

A detailed review of MoraSwap, the niche decentralized exchange, covering its AMM model, fees, liquidity, security risks, user experience, and how it stacks up against larger DEXes.

Read MoreAMM DEX Overview

When working with AMM DEX, an automated market maker decentralized exchange that uses smart contracts to match trades without order books. Also known as automated market maker exchange, it enables instant token swaps while liquidity providers earn rewards.

AMM DEX is a core building block of modern DeFi. It encompasses Liquidity Pools, collections of token pairs that users deposit to facilitate trading. Those pools require Swap Fees, a small charge on each trade that compensates providers. Token Governance influences fee structures and protocol upgrades, shaping how the AMM DEX evolves. Because of these links, Yield Farming drives demand for liquidity, as users chase extra token rewards on top of fee earnings.

Key concepts you’ll explore

Liquidity pools are the heart of any AMM DEX. They hold two or more assets in a constant product formula, letting traders swap at market‑driven rates. The pool’s size determines price impact: deeper pools mean less slippage. Swap fees, usually a fraction of a percent, are split among all providers, turning passive holding into passive income. Token governance adds a community layer; token holders vote on fee tiers, incentive programs, and new pool launches. Yield farming compounds these incentives by offering additional token rewards for staking LP tokens, creating a cycle where higher yields attract more liquidity, which in turn lowers slippage and improves the trading experience.

Understanding how these pieces fit together helps you decide which AMM DEX to use, how much capital to allocate, and which farms are worth the risk. Below you’ll find in‑depth reviews of popular DEXs, fee analyses, security breakdowns, and step‑by‑step guides on setting up your own liquidity positions. Whether you’re a beginner testing the waters or a seasoned trader fine‑tuning your strategy, the articles ahead give you the practical context you need to navigate the AMM DEX landscape with confidence.