A detailed review of MoraSwap, the niche decentralized exchange, covering its AMM model, fees, liquidity, security risks, user experience, and how it stacks up against larger DEXes.

Read MoreMoraSwap Fees

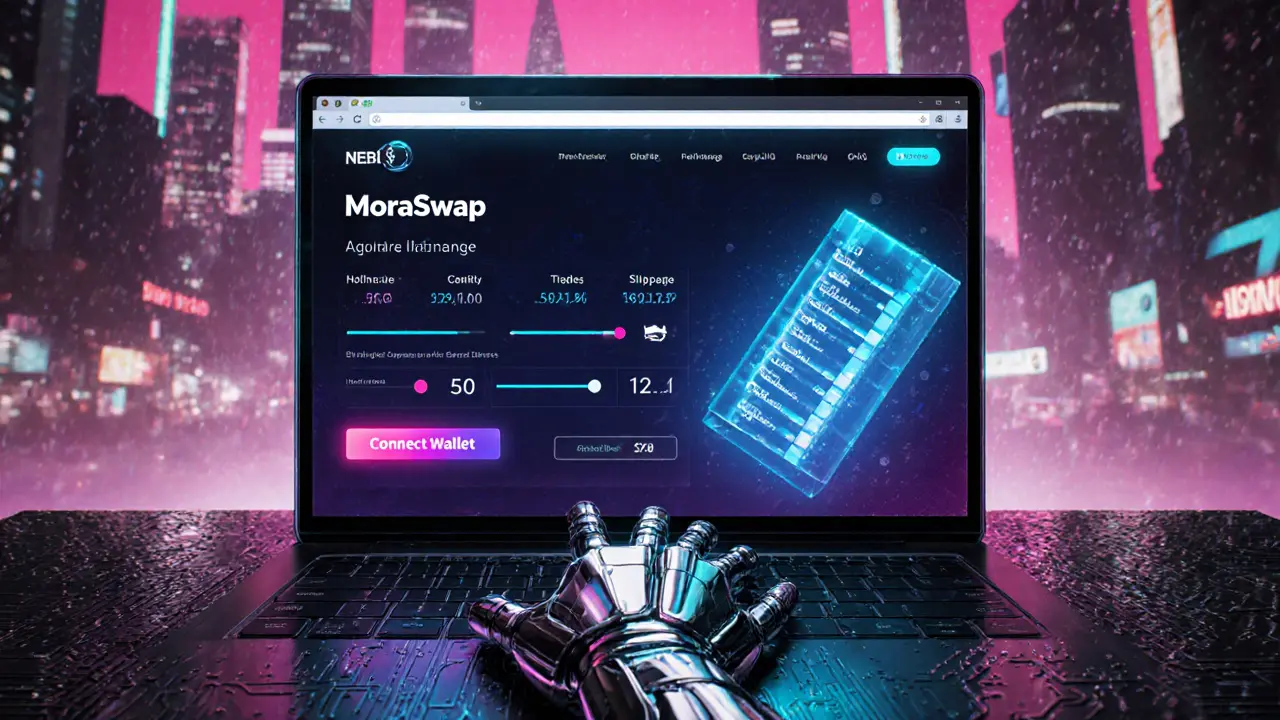

When looking at MoraSwap fees, the charges users pay when swapping tokens on the MoraSwap decentralized exchange. Also known as MoraSwap transaction costs, it directly affects the profitability of every trade. MoraSwap is a DEX built on a programmable blockchain, and its fee model is a key piece of the broader DEX fee structure that governs how liquidity providers, protocol developers, and traders share value. The underlying liquidity pool determines the exact cost per swap, because each pool’s size and token composition shape the slippage and fee percentages. Understanding these three entities—MoraSwap fees, the DEX fee structure, and liquidity pools—forms the foundation for smart DeFi trading.

How the fee model breaks down

At its core, a MoraSwap swap triggers a MoraSwap fees charge that consists of two parts: a base protocol fee (usually a fraction of a percent) and a pool‑specific fee that rewards liquidity providers. The base fee is consistent across the platform, acting like a service charge for using the smart‑contract router. The pool fee varies with the pool’s depth; deeper pools can afford lower percentages, while shallow pools need higher rates to keep providers interested. This relationship creates a semantic triple: "MoraSwap fees encompass both protocol and pool components," and another: "Liquidity pool size influences the pool‑specific fee." Compared to rivals like Uniswap or SushiSwap, MoraSwap often offers a slimmer protocol fee but compensates with dynamic pool fees that can be higher for niche token pairs. Traders who monitor pool depth can time swaps when fees dip, effectively reducing costs without sacrificing speed.

Beyond raw percentages, fee distribution plays a role in token economics. A portion of the collected fees is funneled back into the native MOR token treasury, which can be used for governance votes, buy‑backs, or community grants. This ties the MoraSwap fees directly to the platform’s long‑term health, creating a feedback loop where active users help sustain the ecosystem. Knowing that part of every fee fuels future development lets traders see fees as an investment in the network rather than just a cost. When you combine the fee breakdown, pool dynamics, and token‑backed incentives, you get a full picture of how MoraSwap positions itself in the DeFi fee landscape.

Armed with this context, you can better evaluate the articles in our collection below. Whether you’re hunting for a side‑by‑side comparison with other DEXs, a deep dive into fee calculations for specific token pairs, or strategies to minimize costs by choosing optimal liquidity pools, the posts ahead build on the core concepts we just covered. Dive in to see real‑world examples, data‑driven analyses, and actionable tips that will help you navigate MoraSwap fees with confidence.