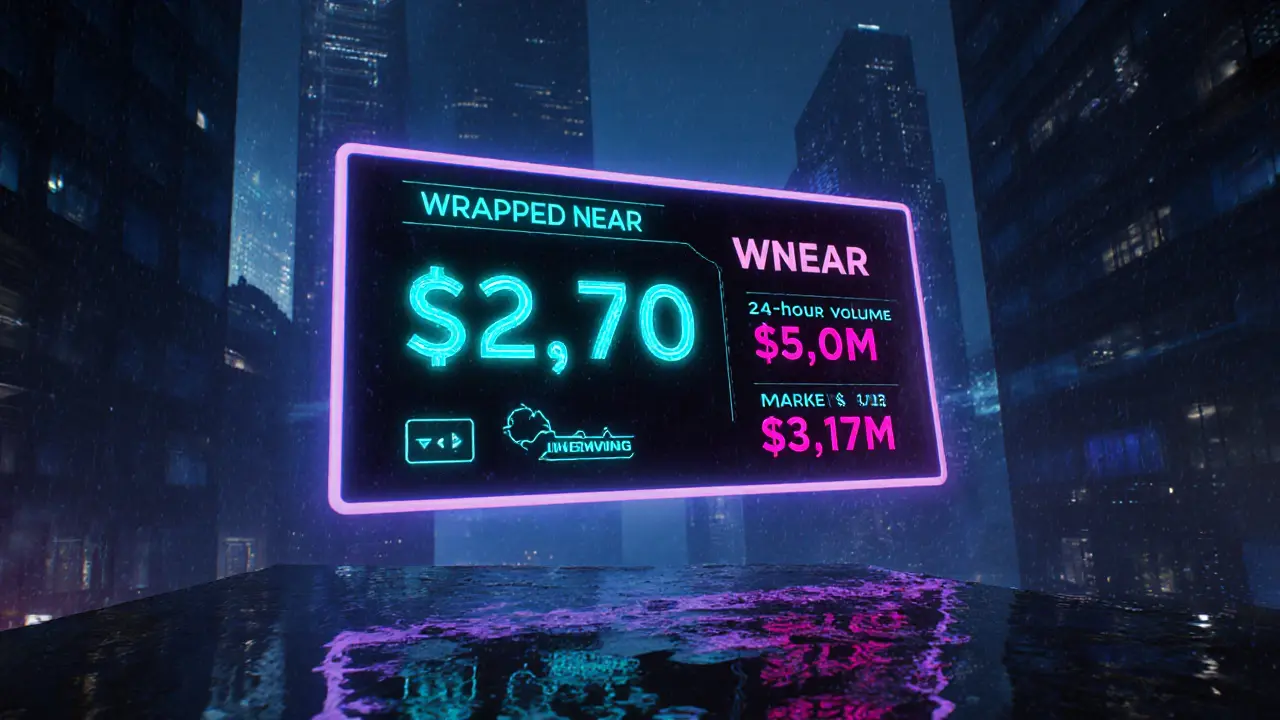

Learn what Wrapped Near (WNEAR) is, how it enables cross‑chain DeFi, where to trade it, and the risks and opportunities for investors.

Read MoreWNEAR – Wrapped NEAR Token Overview

When working with WNEAR, the wrapped version of the NEAR Protocol token that runs on Ethereum‑compatible blockchains. Also known as Wrapped NEAR, it lets users move NEAR value into ecosystems that don’t support the native chain.

The core idea behind NEAR Protocol, a scalable, developer‑friendly layer‑1 blockchain is to provide fast, cheap smart contracts. DeFi, decentralized finance applications that run on public blockchains needs assets that can flow across chains, and that’s where wrapping comes in. In simple terms, WNEAR is a tokenized claim on NEAR that lives on an EVM network, so it WNEAR bridges the gap between two worlds. This relationship means you can earn yields on Ethereum‑based platforms without selling your original NEAR holdings.

Why WNEAR matters for traders and builders

First, WNEAR unlocks liquidity. Liquidity pools on Uniswap, SushiSwap, or any DEX that supports ERC‑20 tokens can now include NEAR’s value, boosting trade volume and price stability. Second, the token’s metadata mirrors the native asset’s supply, so one WNEAR always represents one NEAR. That 1:1 peg is maintained by custodial smart contracts that lock NEAR on the original chain and mint the wrapped counterpart. Third, developers can write smart contracts on Ethereum that interact with WNEAR just like any other ERC‑20, making integration straightforward.

From a staking perspective, WNEAR opens new routes. You can lock WNEAR in yield farms, liquidity mining programs, or even use it as collateral for borrowing on platforms like Aave. Because the underlying NEAR continues to earn its own network rewards, some services let you claim both the NEAR staking rewards and the DeFi yields simultaneously. This multi‑layer earning model is a key attraction for users who want to maximize capital efficiency.

Cross‑chain bridges are the technical backbone of this process. Popular bridges such as Wormhole or Rainbow Bridge handle the locking and minting steps, while audit reports confirm the contracts’ safety. Users should always verify bridge addresses and watch for any announced upgrades before moving large sums. The bridge’s reliability directly influences WNEAR’s peg stability, so staying informed is part of safe participation.

Practical use cases span from simple swaps to complex strategies. A trader might exchange WNEAR for stablecoins to hedge against market swings, then feed the stablecoins into a liquidity pool that rewards both sides of the trade. A DeFi builder could design a lending market where borrowers collateralize with WNEAR, tapping into NEAR’s strong community and low‑fee transactions. Even NFT marketplaces are experimenting with WNEAR as a payment option, allowing creators to tap into both NEAR’s user base and Ethereum’s broad audience.

Risk management is essential. While the 1:1 peg is maintained by smart contracts, any vulnerability in the bridge or the wrapper can lead to temporary de‑peg events. Additionally, regulatory changes affecting wrapped assets could impact liquidity. Keeping an eye on audit reports, community alerts, and official bridge announcements helps mitigate surprises. Using reputable wallets—MetaMask, Trust Wallet, or hardware wallets with bridge support—adds another layer of protection.

For those learning how to trade or test strategies without real money, the Buy Fake Money simulator lets you experiment with WNEAR in a risk‑free environment. You can build demo portfolios, backtest price movements, and practice staking or liquidity provision without risking capital. This hands‑on approach is great for beginners looking to understand wrapped tokens before moving to a live wallet.

Below you’ll find a curated list of articles that dive deeper into WNEAR’s technical details, real‑world applications, and the broader DeFi landscape. Whether you’re a trader, developer, or just curious about how wrapping expands blockchain utility, the posts ahead give you actionable insights and concrete examples.