Learn what Wrapped Near (WNEAR) is, how it enables cross‑chain DeFi, where to trade it, and the risks and opportunities for investors.

Read MoreWrapped Near (WNEAR) – Tokenized NEAR for DeFi and Beyond

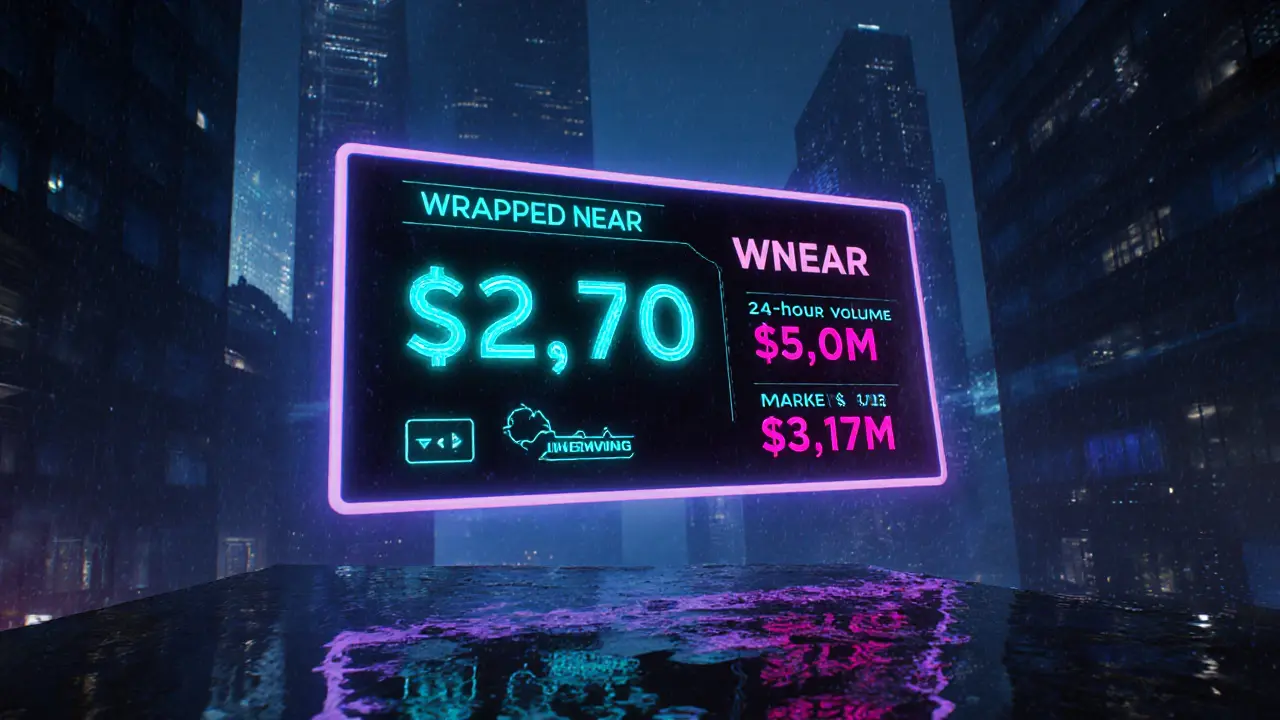

When working with Wrapped Near, a tokenized version of the native NEAR coin that lives on Ethereum‑compatible chains. Also known as WNEAR, it enables NEAR holders to tap into a wide range of DeFi services without leaving their favorite blockchain ecosystem.

To understand why Wrapped Near matters, first meet its foundation: Near Protocol, a high‑throughput, sharded blockchain designed for developer-friendly applications. Near Protocol provides the underlying security and token economics, while Wrapped Tokens, ERC‑20 representations of assets from other chains give those assets a universal wrapper that fits into Ethereum’s tooling.

The magic that connects the two worlds is a Cross‑chain Bridge, a set of smart contracts and validators that lock the original asset on its native chain and mint the wrapped counterpart on the target chain. This bridge ensures price parity, prevents double‑spending, and lets liquidity flow freely between Near and Ethereum ecosystems.

Wrapped Near encompasses three core ideas: (1) it is a bridge‑backed ERC‑20 asset, (2) it requires a secure cross‑chain infrastructure, and (3) it unlocks DeFi participation for NEAR holders. DeFi protocols need Wrapped Near to create liquidity pools, enable yield farming, or serve as collateral for borrowing. Investors benefit because Wrapped Near mirrors NEAR’s price 1:1, giving them exposure to Near’s growth while using familiar Ethereum tools.

In practice, this tokenization opens doors to many real‑world actions. You can supply WNEAR to automated market makers like Uniswap or SushiSwap, earn fees as a liquidity provider, or stake it in lending platforms for passive income. Because the bridge locks the original NEAR, the token remains fully backed, and any withdrawal simply burns the ERC‑20 token and releases the native asset. This model mirrors how other wrapped assets—such as Wrapped Bitcoin (WBTC) or Wrapped Ether (WETH)—have expanded the possibilities of decentralized finance.

Our collection of articles below reflects the full spectrum of Wrapped Near’s ecosystem. You’ll find in‑depth exchange reviews that show how platforms handle WNEAR deposits and withdrawals, detailed guides on using bridges safely, and comparisons of staking versus lending strategies that include Wrapped Near as a case study. Whether you’re a beginner trying to move NEAR into DeFi or an experienced trader looking for the best fee structures, the posts give actionable insight backed by real‑world data.

What you’ll discover in this section

The list covers exchange performance, bridge security, tokenomics, and practical use‑cases. Each article breaks down complex concepts into step‑by‑step instructions, so you can confidently navigate the Wrapped Near landscape. From checking fee tiers on popular DEXs to evaluating cross‑chain bridge auditors, the guides keep you informed and ready to act.

Now that you know how Wrapped Near fits into the broader Near Protocol, Wrapped Tokens, and cross‑chain bridge universe, dive into the articles below. They’ll help you turn theory into practice, spot the best opportunities, and avoid common pitfalls when working with WNEAR.