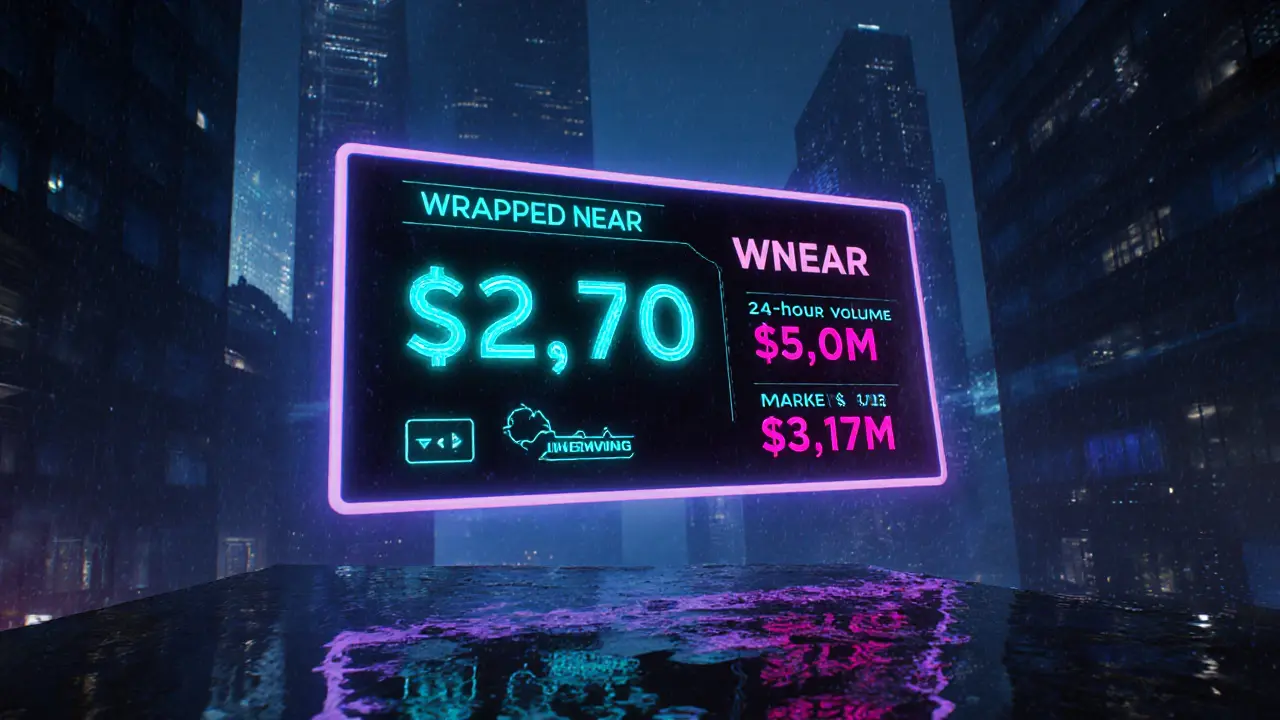

Learn what Wrapped Near (WNEAR) is, how it enables cross‑chain DeFi, where to trade it, and the risks and opportunities for investors.

Read MoreWrapped Token: Definition, Uses, and Impact

When working with Wrapped Token, a blockchain asset that represents another asset from a different chain, enabling its use on the host network. Also known as wrapped asset, it bridges value between ecosystems without moving the original coin.

The core idea is simple: you lock the original asset on its native chain, mint a matching token on another chain, and let users trade or stake it there. This wrapped token model relies on trust‑less smart contracts that keep the peg 1:1. Attributes you’ll see include the underlying asset (e.g., Bitcoin), the host network (e.g., Ethereum), the bridge protocol, and the liquidity provided by market makers.

Key Related Concepts

One of the most important helpers is the Cross‑Chain Bridge, software that locks assets on one chain and mints representations on another, ensuring security and transparency. Bridges enable tokenization, which is the process of converting real‑world or off‑chain value into a digital token. Tokenization Tokenization, the act of issuing a blockchain‑based representation of an asset, opens doors for fractional ownership and global liquidity. Together, these concepts let DeFi platforms offer Bitcoin‑backed loans, earn yield on otherwise illiquid assets, and create new trading pairs without needing the original coin to reside on the same chain.

DeFi protocols also lean heavily on Smart Contracts, self‑executing code that enforces the rules of a wrapped token, from minting to redemption. Smart contracts guarantee that when you burn the wrapped token, the original asset is released back to you. This automation reduces counterparty risk and makes the whole system scalable. In practice, you’ll see wrapped tokens like WBTC, renBTC, or wETH used as collateral on lending platforms, as liquidity providers in automated market makers, or as base pairs for swapping on DEXs.

Why does this matter to you? First, wrapped tokens let you tap into a broader set of opportunities without holding multiple wallets. Second, they bring price discovery and arbitrage possibilities across chains, which can improve overall market efficiency. Finally, they lower entry barriers for investors who want exposure to assets that are otherwise hard to access on a given network.

Of course, there are risks. Bridge exploits can lead to massive losses if the locking contract is compromised. Peg stability depends on the reliability of the custodians or the decentralised validators. Also, gas fees on the host chain can make transactions expensive, especially during network congestion. Understanding these trade‑offs helps you decide whether to use wrapped tokens for trading, borrowing, or long‑term holding.

Below you’ll find a curated set of articles that dive deeper into specific wrapped token use cases, bridge security audits, tokenomics breakdowns, and step‑by‑step guides for creating or redeeming wrapped assets. Whether you’re a beginner curious about the concept or a seasoned trader looking for the latest security insights, the collection offers practical takeaways and detailed analysis to help you navigate the wrapped token landscape.